39. Irrelevance of Capital Structures with Complete Markets#

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install --upgrade quantecon

!conda install -y -c plotly plotly plotly-orca

39.1. Introduction#

This is a prolegomenon to another lecture Equilibrium Capital Structures with Incomplete Markets about a model with incomplete markets authored by Bisin, Clementi, and Gottardi [Bisin et al., 2018].

We adopt specifications of preferences and technologies very close to Bisin, Clemente, and Gottardi’s but unlike them assume that there are complete markets in one-period Arrow securities.

This simplification of BCG’s setup helps us by

creating a benchmark economy to compare with outcomes in BCG’s incomplete markets economy

creating a good guess for initial values of some equilibrium objects to be computed in BCG’s incomplete markets economy via an iterative algorithm

illustrating classic complete markets outcomes that include

indeterminacy of consumers’ portfolio choices

indeterminacy of firms’ financial structures that underlies a Modigliani-Miller theorem [Modigliani and Miller, 1958]

introducing

Big K, little kissues in a simple context that will recur in the BCG incomplete markets environment

A Big K, little k analysis also played roles in this quantecon lecture as well as here and here.

39.1.1. Setup#

The economy lasts for two periods, \(t=0, 1\).

There are two types of consumers named \(i=1,2\).

A scalar random variable \(\epsilon\) with probability density \(g(\epsilon)\) affects both

the return in period \(1\) from investing \(k \geq 0\) in physical capital in period \(0\).

exogenous period \(1\) endowments of the consumption good for agents of types \(i =1\) and \(i=2\).

Type \(i=1\) and \(i=2\) agents’ period \(1\) endowments are correlated with the return on physical capital in different ways.

We discuss two arrangements:

a command economy in which a benevolent planner chooses \(k\) and allocates goods to the two types of consumers in each period and each random second period state

a competitive equilibrium with markets in claims on physical capital and a complete set (possibly a continuum) of one-period Arrow securities that pay period \(1\) consumption goods contingent on the realization of random variable \(\epsilon\).

39.1.2. Endowments#

There is a single consumption good in period \(0\) and at each random state \(\epsilon\) in period \(1\).

Economy-wide endowments in periods \(0\) and \(1\) are

Soon we’ll explain how aggregate endowments are divided between type \(i=1\) and type \(i=2\) consumers.

We don’t need to do that in order to describe a social planning problem.

39.1.3. Technology:#

Where \(\alpha \in (0,1)\) and \(A >0\)

39.1.4. Preferences:#

A consumer of type \(i\) orders period \(0\) consumption \(c_0^i\) and state \(\epsilon\), period \(1\) consumption \(c^i_1(\epsilon)\) by

\(\beta \in (0,1)\) and the one-period utility function is

39.1.5. Parameterizations#

Following BCG, we shall employ the following parameterizations:

Sometimes instead of asuming \(\epsilon \sim g(\epsilon) = {\mathcal N}(0,\sigma^2)\), we’ll assume that \(g(\cdot)\) is a probability mass function that serves as a discrete approximation to a standardized normal density.

39.1.6. Pareto criterion and planning problem#

The planner’s objective function is

where \(\phi_i \geq 0\) is a Pareto weight that the planner attaches to a consumer of type \(i\).

We form the following Lagrangian for the planner’s problem:

First-order necessary optimality conditions for the planning problem are:

The first four equations imply that

These together with the fifth first-order condition for the planner imply the following equation that determines an optimal choice of capital

for \(i = 1,2\).

39.1.7. Helpful observations and bookkeeping#

Evidently,

and

where it is to be understood that this equation holds for \(c^1 = c^1_0\) and \(c^2 = c^2_0\) and also for \(c^1 = c^1(\epsilon)\) and \(c^2 = c^2(\epsilon)\) for all \(\epsilon\).

With the same understanding, it follows that

Let \(c= c^1 + c^2\).

It follows from the preceding equation that

where \(\eta \in [0,1]\) is a function of \(\phi_1\) and \(\gamma\).

Consequently, we can write the planner’s first-order condition for \(k\) as

which is one equation to be solved for \(k \geq 0\).

Anticipating a Big K, little k idea widely used in macroeconomics,

to be discussed in detail below, let \(K\) be the value of \(k\)

that solves the preceding equation so that

The associated optimal consumption allocation is

where \(\eta \in [0,1]\) is the consumption share parameter mentioned above that is a function of the Pareto weight \(\phi_1\) and the utility curvature parameter \(\gamma\).

39.1.7.1. Remarks#

The relative Pareto weight parameter \(\eta\) does not appear in equation (39.1) that determines \(K\).

Neither does it influence \(C_0\) or \(C_1(\epsilon)\), which depend solely on \(K\).

The role of \(\eta\) is to determine how to allocate total consumption between the two types of consumers.

Thus, the planner’s choice of \(K\) does not interact with how it wants to allocate consumption.

39.2. Competitive equilibrium#

We now describe a competitive equilibrium for an economy that has specifications of consumer preferences, technology, and aggregate endowments that are identical to those in the preceding planning problem.

While prices do not appear in the planning problem – only quantities do – prices play an important role in a competitive equilibrium.

To understand how the planning economy is related to a competitive

equilibrium, we now turn to the Big K, little k distinction.

39.2.1. Measures of agents and firms#

We follow BCG in assuming that there are unit measures of

consumers of type \(i=1\)

consumers of type \(i=2\)

firms with access to the production technology that converts \(k\) units of time \(0\) good into \(A k^\alpha e^\epsilon\) units of the time \(1\) good in random state \(\epsilon\)

Thus, let \(\omega \in [0,1]\) index a particular consumer of type \(i\).

Then define Big \(C^i\) as

In the same spirit, let \(\zeta \in [0,1]\) index a particular firm. Then define Big \(K\) as

The assumption that there are continua of our three types of agents plays an important role making each individual agent into a powerless price taker:

an individual consumer chooses its own (infinesimal) part \(c^i(\omega)\) of \(C^i\) taking prices as given

an individual firm chooses its own (infinitesmimal) part \(k(\zeta)\) of \(K\) taking prices as

equilibrium prices depend on the

Big K, Big Cobjects \(K\) and \(C\)

Nevertheless, in equilibrium, \(K = k, C^i = c^i\)

The assumption about measures of agents is thus a powerful device for making a host of competitive agents take as given equilibrium prices that are determined by the independent decisions of hosts of agents who behave just like they do.

39.2.1.1. Ownership#

Consumers of type \(i\) own the following exogenous quantities of the consumption good in periods \(0\) and \(1\):

where

Consumers also own shares in a firm that operates the technology for converting nonnegative amounts of the time \(0\) consumption good one-for-one into a capital good \(k\) that produces \(A k^\alpha e^\epsilon\) units of the time \(1\) consumption good in time \(1\) state \(\epsilon\).

Consumers of types \(i=1,2\) are endowed with \(\theta_0^i\) shares of a firm and

39.2.1.2. Asset markets#

At time \(0\), consumers trade the following assets with other consumers and with firms:

equities (also known as stocks) issued by firms

one-period Arrow securities that pay one unit of consumption at time \(1\) when the shock \(\epsilon\) assumes a particular value

Later, we’ll allow the firm to issue bonds too, but not now.

39.2.2. Objects appearing in a competitive equilibrium#

Let

\(a^i(\epsilon)\) be consumer \(i\) ’s purchases of claims on time \(1\) consumption in state \(\epsilon\)

\(q(\epsilon)\) be a pricing kernel for one-period Arrow securities

\(\theta_0^i \geq 0\) be consumer \(i\)’s intial share of the firm, \(\sum_i \theta_0^i =1\)

\(\theta^i\) be the fraction of a firm’s shares purchased by consumer \(i\) at time \(t=0\)

\(V\) be the value of the representative firm

\(\tilde V\) be the value of equity issued by the representative firm

\(K, C_0\) be two scalars and \(C_1(\epsilon)\) a function that we use to construct a guess about an equilibrium pricing kernel for Arrow securities

We proceed to describe constrained optimum problems faced by consumers and a representative firm in a competitive equilibrium.

39.2.3. A representative firm’s problem#

A representative firm takes Arrow security prices \(q(\epsilon)\) as given.

The firm purchases capital \(k \geq 0\) from consumers at time \(0\) and finances itself by issuing equity at time \(0\).

The firm produces time \(1\) goods \(A k^\alpha e^\epsilon\) in

state \(\epsilon\) and pays all of these earnings to owners of its

equity.

The value of a firm’s equity at time \(0\) can be computed by multiplying its state-contingent earnings by their Arrow securities prices and then adding over all contingencies:

Owners of a firm want it to choose \(k\) to maximize

The firm’s first-order necessary condition for an optimal \(k\) is

The time \(0\) value of a representative firm is

The right side equals the value of equity minus the cost of the time \(0\) goods that it purchases and uses as capital.

39.2.4. A consumer’s problem#

We now pose a consumer’s problem in a competitive equilibrium.

As a price taker, each consumer faces a given Arrow securities pricing kernel \(q(\epsilon)\), a given value of a firm \(V\) that has chosen capital stock \(k\), a price of equity \(\tilde V\), and prospective next period random dividends \(A k^\alpha e^\epsilon\).

If we evaluate consumer \(i\)’s time \(1\) budget constraint at zero consumption \(c^i_1(\epsilon) = 0\) and solve for \(-a^i(\epsilon)\) we obtain

The quantity \(- \bar a^i(\epsilon;\theta^i)\) is the maximum amount that it is feasible for consumer \(i\) to repay to his Arrow security creditors at time \(1\) in state \(\epsilon\).

Notice that \(-\bar a^i(\epsilon;\theta^i)\) defined in (39.2) depends on

his endowment \(w_1^i(\epsilon)\) at time \(1\) in state \(\epsilon\)

his share \(\theta^i\) of a representive firm’s dividends

These constitute two sources of collateral that back the consumer’s issues of Arrow securities that pay off in state \(\epsilon\)

Consumer \(i\) chooses a scalar \(c_0^i\) and a function \(c_1^i(\epsilon)\) to maximize

subject to time \(0\) and time \(1\) budget constraints

Attach Lagrange multiplier \(\lambda_0^i\) to the budget constraint at time \(0\) and scaled Lagrange multiplier \(\beta \lambda_1^i(\epsilon) g(\epsilon)\) to the budget constraint at time \(1\) and state \(\epsilon\), then form the Lagrangian

Off corners, first-order necessary conditions for an optimum with respect to \(c_0^i, c_1^i(\epsilon),\) and \(a^i(\epsilon)\) are

These equations imply that consumer \(i\) adjusts its consumption plan to satisfy

To deduce a restriction on equilibrium prices, we solve the period \(1\) budget constraint to express \(a^i(\epsilon)\) as

then substitute the expression on the right side into the time \(0\) budget constraint and rearrange to get the single intertemporal budget constraint

The right side of inequality (39.4) is the present value of consumer \(i\)’s consumption while the left side is the present value of consumer \(i\)’s endowment when consumer \(i\) buys \(\theta^i\) shares of equity.

From inequality (39.4), we deduce two findings.

1. No arbitrage profits condition:

Unless

an arbitrage opportunity would be open.

If

the consumer could afford an arbitrarily high present value of consumption by setting \(\theta^i\) to an arbitrarily large negative number.

If

the consumer could afford an arbitrarily high present value of consumption by setting \(\theta^i\) to be arbitrarily large positive number.

Since resources are finite, there can exist no such arbitrage opportunity in a competitive equilibrium.

Therefore, it must be true that the following no arbitrage condition prevails:

Equation (39.6) asserts that the value of equity equals the value of the state-contingent dividends \(Ak^\alpha e^\epsilon\) evaluated at the Arrow security prices \(q(\epsilon; K)\) that we have expressed as a function of \(K\).

We’ll say more about this equation later.

2. Indeterminacy of portfolio

When the no-arbitrage pricing equation (39.6) prevails, a consumer of type \(i\)’s choice \(\theta^i\) of equity is indeterminate.

Consumer of type \(i\) can offset any choice of \(\theta^i\) by setting an appropriate schedule \(a^i(\epsilon)\) for purchasing state-contingent securities.

39.2.5. Computing competitive equilibrium prices and quantities#

Having computed an allocation that solves the planning problem, we can

readily compute a competitive equilibrium via the following steps that,

as we’ll see, relies heavily on the Big K, little k,

Big C, little c logic mentioned earlier:

a competitive equilbrium allocation equals the allocation chosen by the planner

competitive equilibrium prices and the value of a firm’s equity are encoded in shadow prices from the planning problem that depend on Big \(K\) and Big \(C\).

To substantiate that this procedure is valid, we proceed as follows.

With \(K\) in hand, we make the following guess for competitive equilibrium Arrow securities prices

To confirm the guess, we begin by considering its consequences for the firm’s choice of \(k\).

With Arrow securities prices (39.7), the firm’s first-order necessary condition for choosing \(k\) becomes

which can be verified to be satisfied if the firm sets

because by setting \(k=K\) equation (39.8) becomes equivalent with the planner’s first-order condition (39.1) for setting \(K\).

To pose a consumer’s problem in a competitive equilibrium, we require not only the above guess for the Arrow securities pricing kernel \(q(\epsilon)\) but the value of equity \(\tilde V\):

Let \(\tilde V\) be the value of equity implied by Arrow securities price function (39.7) and formula (39.9).

At the Arrow securities prices \(q(\epsilon)\) given by (39.7) and equity value \(\tilde V\) given by (39.9), consumer \(i=1,2\) choose consumption allocations and portolios that satisfy the first-order necessary conditions

It can be verified directly that the following choices satisfy these equations

for an \(\eta \in (0,1)\) that depends on consumers’ endowments \([w_0^1, w_0^2, w_1^1(\epsilon), w_1^2(\epsilon), \theta_0^1, \theta_0^2 ]\).

Remark: Multiple arrangements of endowments \([w_0^1, w_0^2, w_1^1(\epsilon), w_1^2(\epsilon), \theta_0^1, \theta_0^2 ]\) associated with the same distribution of wealth \(\eta\). Can you explain why?

Hint

Think about the portfolio indeterminacy finding above.

39.2.6. Modigliani-Miller theorem#

We now allow a firm to issue both bonds and equity.

Payouts from equity and bonds, respectively, are

Thus, one unit of the bond pays one unit of consumption at time \(1\) in state \(\epsilon\) if \(A k^\alpha e^\epsilon - b \geq 0\), which is true when \(\epsilon \geq \epsilon^* = \log \frac{b}{Ak^\alpha}\), and pays \(\frac{A k^\alpha e^\epsilon}{b}\) units of time \(1\) consumption in state \(\epsilon\) when \(\epsilon < \epsilon^*\).

The value of the firm is now the sum of equity plus the value of bonds, which we denote

where \(p(k,b)\) is the price of one unit of the bond when a firm with \(k\) units of physical capital issues \(b\) bonds.

We continue to assume that there are complete markets in Arrow securities with pricing kernel \(q(\epsilon)\).

A version of the no-arbitrage-in-equilibrium argument that we presented earlier implies that the value of equity and the price of bonds are

Consequently, the value of the firm is

which is the same expression that we obtained above when we assumed that the firm issued only equity.

We thus obtain a version of the celebrated Modigliani-Miller theorem [Modigliani and Miller, 1958] about firms’ finance:

Modigliani-Miller theorem:

The value of a firm is independent the mix of equity and bonds that it uses to finance its physical capital.

The firms’s decision about how much physical capital to purchase does not depend on whether it finances those purchases by issuing bonds or equity

The firm’s choice of whether to finance itself by issuing equity or bonds is indeterminant

Please note the role of the assumption of complete markets in Arrow securities in substantiating these claims.

In Equilibrium Capital Structures with Incomplete Markets, we will assume that markets are (very) incomplete – we’ll shut down markets in almost all Arrow securities.

That will pull the rug from underneath the Modigliani-Miller theorem.

39.3. Code#

We create a class object BCG_complete_markets to compute

equilibrium allocations of the complete market BCG model given a list

of parameter values.

It consists of 4 functions that do the following things:

opt_kcomputes the planner’s optimal capital \(K\)First, create a grid for capital.

Then for each value of capital stock in the grid, compute the left side of the planner’s first-order necessary condition for \(k\), that is,

\[ \beta \alpha A K^{\alpha -1} \int \left( \frac{w_1(\epsilon) + A K^\alpha e^\epsilon}{w_0 - K } \right)^{-\gamma} e^\epsilon g(\epsilon) d \epsilon - 1 =0 \]Find \(k\) that solves this equation.

qcomputes Arrow security prices as a function of the productivity shock \(\epsilon\) and capital \(K\):\[ q(\epsilon;K) = \beta \left( \frac{u'\left( w_1(\epsilon) + A K^\alpha e^\epsilon\right)} {u'(w_0 - K )} \right) \]Vsolves for the firm value given capital \(k\):\[ V = - k + \int A k^\alpha e^\epsilon q(\epsilon; K) d \epsilon \]opt_ccomputes optimal consumptions \(c^i_0\), and \(c^i(\epsilon)\):The function first computes weight \(\eta\) using the budget constraint for agent 1:

\[ w_0^1 + \theta_0^1 V + \int w_1^1(\epsilon) q(\epsilon) d \epsilon = c_0^1 + \int c_1^1(\epsilon) q(\epsilon) d \epsilon = \eta \left( C_0 + \int C_1(\epsilon) q(\epsilon) d \epsilon \right) \]where

\[ \begin{aligned} C_0 & = w_0 - K \cr C_1(\epsilon) & = w_1(\epsilon) + A K^\alpha e^\epsilon \cr \end{aligned} \]It computes consumption for each agent as

\[ \begin{aligned} c_0^1 & = \eta C_0 \cr c_0^2 & = (1 - \eta) C_0 \cr c_1^1(\epsilon) & = \eta C_1 (\epsilon) \cr c_1^2 (\epsilon) & = (1 - \eta) C_1(\epsilon) \end{aligned} \]

The list of parameters includes:

\(\chi_1\), \(\chi_2\): Correlation parameters for agents 1 and 2. Default values are 0 and 0.9, respectively.

\(w^1_0\), \(w^2_0\): Initial endowments. Default values are 1.

\(\theta^1_0\), \(\theta^2_0\): Consumers’ initial shares of a representative firm. Default values are 0.5.

\(\psi\): CRRA risk parameter. Default value is 3.

\(\alpha\): Returns to scale production function parameter. Default value is 0.6.

\(A\): Productivity of technology. Default value is 2.5.

\(\mu\), \(\sigma\): Mean and standard deviation of the log of the shock. Default values are -0.025 and 0.4, respectively.

\(\beta\): time preference discount factor. Default value is .96.

nb_points_integ: number of points used for integration through Gauss-Hermite quadrature: default value is 10

import numpy as np

import matplotlib.pyplot as plt

from scipy.stats import norm

from numba import njit, prange

from quantecon.optimize import root_finding

#=========== Class: BCG for complete markets ===========#

class BCG_complete_markets:

# init method or constructor

def __init__(self,

𝜒1 = 0,

𝜒2 = 0.9,

w10 = 1,

w20 = 1,

𝜃10 = 0.5,

𝜃20 = 0.5,

𝜓 = 3,

𝛼 = 0.6,

A = 2.5,

𝜇 = -0.025,

𝜎 = 0.4,

𝛽 = 0.96,

nb_points_integ = 10):

#=========== Setup ===========#

# Risk parameters

self.𝜒1 = 𝜒1

self.𝜒2 = 𝜒2

# Other parameters

self.𝜓 = 𝜓

self.𝛼 = 𝛼

self.A = A

self.𝜇 = 𝜇

self.𝜎 = 𝜎

self.𝛽 = 𝛽

# Utility

self.u = lambda c: (c**(1-𝜓)) / (1-𝜓)

# Production

self.f = njit(lambda k: A * (k ** 𝛼))

self.Y = lambda 𝜖, k: np.exp(𝜖) * self.f(k)

# Initial endowments

self.w10 = w10

self.w20 = w20

self.w0 = w10 + w20

# Initial holdings

self.𝜃10 = 𝜃10

self.𝜃20 = 𝜃20

# Endowments at t=1

w11 = njit(lambda 𝜖: np.exp(-𝜒1*𝜇 - 0.5*(𝜒1**2)*(𝜎**2) + 𝜒1*𝜖))

w21 = njit(lambda 𝜖: np.exp(-𝜒2*𝜇 - 0.5*(𝜒2**2)*(𝜎**2) + 𝜒2*𝜖))

self.w11 = w11

self.w21 = w21

self.w1 = njit(lambda 𝜖: w11(𝜖) + w21(𝜖))

# Normal PDF

self.g = lambda x: norm.pdf(x, loc=𝜇, scale=𝜎)

# Integration

x, self.weights = np.polynomial.hermite.hermgauss(nb_points_integ)

self.points_integral = np.sqrt(2) * 𝜎 * x + 𝜇

self.k_foc = k_foc_factory(self)

#=========== Optimal k ===========#

# Function: solve for optimal k

def opt_k(self, plot=False):

w0 = self.w0

# Grid for k

kgrid = np.linspace(1e-4, w0-1e-4, 100)

# get FONC values for each k in the grid

kfoc_list = [];

for k in kgrid:

kfoc = self.k_foc(k, self.𝜒1, self.𝜒2)

kfoc_list.append(kfoc)

# Plot FONC for k

if plot:

fig, ax = plt.subplots(figsize=(8,7))

ax.plot(kgrid, kfoc_list, color='blue', label=r'FONC for k')

ax.axhline(0, color='red', linestyle='--')

ax.legend()

ax.set_xlabel(r'k')

plt.show()

# Find k that solves the FONC

kk = root_finding.newton_secant(self.k_foc, 1e-2, args=(self.𝜒1, self.𝜒2)).root

return kk

#=========== Arrow security price ===========#

# Function: Compute Arrow security price

def q(self,𝜖,k):

𝛽 = self.𝛽

𝜓 = self.𝜓

w0 = self.w0

w1 = self.w1

fk = self.f(k)

g = self.g

return 𝛽 * ((w1(𝜖) + np.exp(𝜖)*fk) / (w0 - k))**(-𝜓)

#=========== Firm value V ===========#

# Function: compute firm value V

def V(self, k):

q = self.q

fk = self.f(k)

weights = self.weights

integ = lambda 𝜖: np.exp(𝜖) * fk * q(𝜖, k)

return -k + (weights @ integ(self.points_integral)) / np.sqrt(np.pi)

#=========== Optimal c ===========#

# Function: Compute optimal consumption choices c

def opt_c(self, k=None, plot=False):

w1 = self.w1

w0 = self.w0

w10 = self.w10

w11 = self.w11

𝜃10 = self.𝜃10

Y = self.Y

q = self.q

V = self.V

weights = self.weights

if k is None:

k = self.opt_k()

# Solve for the ratio of consumption 𝜂 from the intertemporal B.C.

fk = self.f(k)

c1 = lambda 𝜖: (w1(𝜖) + np.exp(𝜖)*fk)*q(𝜖,k)

denom = (weights @ c1(self.points_integral)) / np.sqrt(np.pi) + (w0 - k)

w11q = lambda 𝜖: w11(𝜖)*q(𝜖,k)

num = w10 + 𝜃10 * V(k) + (weights @ w11q(self.points_integral)) / np.sqrt(np.pi)

𝜂 = num / denom

# Consumption choices

c10 = 𝜂 * (w0 - k)

c20 = (1-𝜂) * (w0 - k)

c11 = lambda 𝜖: 𝜂 * (w1(𝜖)+Y(𝜖,k))

c21 = lambda 𝜖: (1-𝜂) * (w1(𝜖)+Y(𝜖,k))

return c10, c20, c11, c21

def k_foc_factory(model):

𝜓 = model.𝜓

f = model.f

𝛽 = model.𝛽

𝛼 = model.𝛼

A = model.A

𝜓 = model.𝜓

w0 = model.w0

𝜇 = model.𝜇

𝜎 = model.𝜎

weights = model.weights

points_integral = model.points_integral

w11 = njit(lambda 𝜖, 𝜒1, : np.exp(-𝜒1*𝜇 - 0.5*(𝜒1**2)*(𝜎**2) + 𝜒1*𝜖))

w21 = njit(lambda 𝜖, 𝜒2: np.exp(-𝜒2*𝜇 - 0.5*(𝜒2**2)*(𝜎**2) + 𝜒2*𝜖))

w1 = njit(lambda 𝜖, 𝜒1, 𝜒2: w11(𝜖, 𝜒1) + w21(𝜖, 𝜒2))

@njit

def integrand(𝜖, 𝜒1, 𝜒2, k=1e-4):

fk = f(k)

return (w1(𝜖, 𝜒1, 𝜒2) + np.exp(𝜖) * fk) ** (-𝜓) * np.exp(𝜖)

@njit

def k_foc(k, 𝜒1, 𝜒2):

int_k = (weights @ integrand(points_integral, 𝜒1, 𝜒2, k=k)) / np.sqrt(np.pi)

mul = 𝛽 * 𝛼 * A * k ** (𝛼 - 1) / ((w0 - k) ** (-𝜓))

val = mul * int_k - 1

return val

return k_foc

39.3.1. Examples#

Below we provide some examples of how to use BCG_complete markets.

39.3.1.1. 1st example#

In the first example, we set up instances of BCG complete markets models.

We can use either default parameter values or set parameter values as we want.

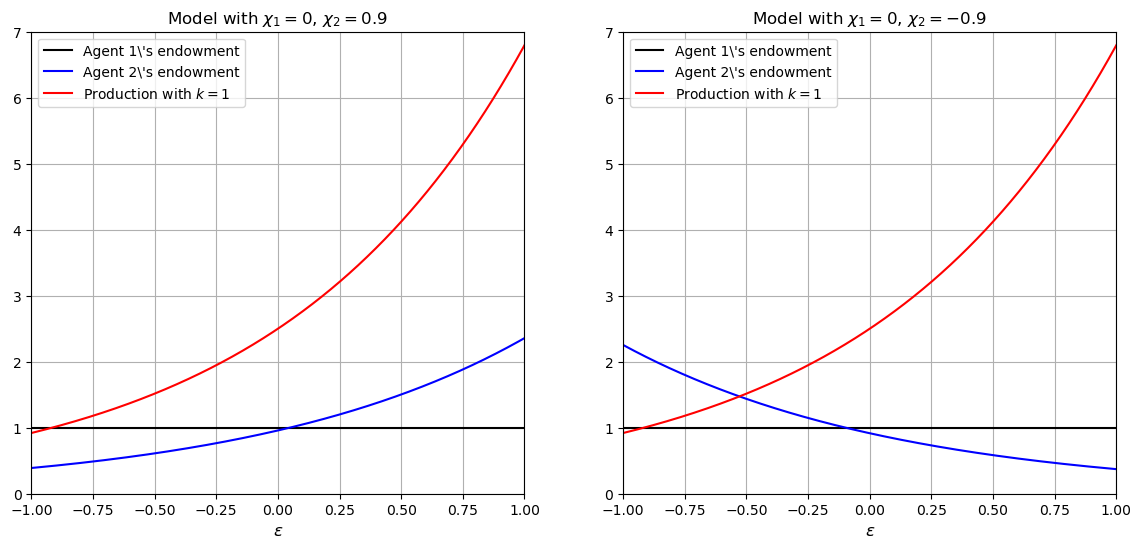

The two instances of the BCG complete markets model, mdl1 and

mdl2, represent the model with default parameter settings and with agent 2’s income correlation altered to be \(\chi_2 = -0.9\),

respectively.

# Example: BCG model for complete markets

mdl1 = BCG_complete_markets()

mdl2 = BCG_complete_markets(𝜒2=-0.9)

Let’s plot the agents’ time-1 endowments with respect to shocks to see the difference in the two models:

#==== Figure 1: HH endowments and firm productivity ====#

# Realizations of innovation from -3 to 3

epsgrid = np.linspace(-1,1,1000)

fig, ax = plt.subplots(1,2,figsize=(14,6))

ax[0].plot(epsgrid, mdl1.w11(epsgrid), color='black', label=r'Agent 1\'s endowment')

ax[0].plot(epsgrid, mdl1.w21(epsgrid), color='blue', label=r'Agent 2\'s endowment')

ax[0].plot(epsgrid, mdl1.Y(epsgrid,1), color='red', label=r'Production with $k=1$')

ax[0].set_xlim([-1,1])

ax[0].set_ylim([0,7])

ax[0].set_xlabel(r'$\epsilon$',fontsize=12)

ax[0].set_title(r'Model with $\chi_1 = 0$, $\chi_2 = 0.9$')

ax[0].legend()

ax[0].grid()

ax[1].plot(epsgrid, mdl2.w11(epsgrid), color='black', label=r'Agent 1\'s endowment')

ax[1].plot(epsgrid, mdl2.w21(epsgrid), color='blue', label=r'Agent 2\'s endowment')

ax[1].plot(epsgrid, mdl2.Y(epsgrid,1), color='red', label=r'Production with $k=1$')

ax[1].set_xlim([-1,1])

ax[1].set_ylim([0,7])

ax[1].set_xlabel(r'$\epsilon$',fontsize=12)

ax[1].set_title(r'Model with $\chi_1 = 0$, $\chi_2 = -0.9$')

ax[1].legend()

ax[1].grid()

plt.show()

Let’s also compare the optimal capital stock, \(k\), and optimal time-0 consumption of agent 2, \(c^2_0\), for the two models:

# Print optimal k

kk_1 = mdl1.opt_k()

kk_2 = mdl2.opt_k()

print('The optimal k for model 1: {:.5f}'.format(kk_1))

print('The optimal k for model 2: {:.5f}'.format(kk_2))

# Print optimal time-0 consumption for agent 2

c20_1 = mdl1.opt_c(k=kk_1)[1]

c20_2 = mdl2.opt_c(k=kk_2)[1]

print('The optimal c20 for model 1: {:.5f}'.format(c20_1))

print('The optimal c20 for model 2: {:.5f}'.format(c20_2))

The optimal k for model 1: 0.14235

The optimal k for model 2: 0.13791

The optimal c20 for model 1: 0.90205

The optimal c20 for model 2: 0.92862

39.3.1.2. 2nd example#

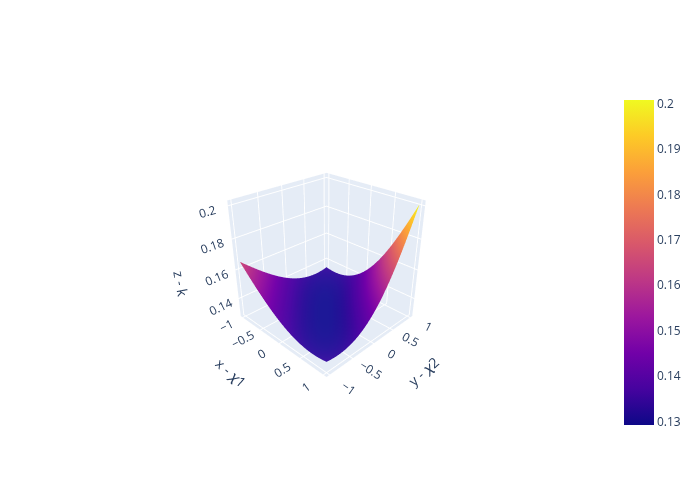

In the second example, we illustrate how the optimal choice of \(k\) is influenced by the correlation parameter \(\chi_i\).

We will need to install the plotly package for 3D illustration. See

https://plotly.com/python/getting-started/ for further instructions.

# Mesh grid of 𝜒

N = 30

𝜒1grid, 𝜒2grid = np.meshgrid(np.linspace(-1,1,N),

np.linspace(-1,1,N))

k_foc = k_foc_factory(mdl1)

# Create grid for k

kgrid = np.zeros_like(𝜒1grid)

w0 = mdl1.w0

@njit(parallel=True)

def fill_k_grid(kgrid):

# Loop: Compute optimal k and

for i in prange(N):

for j in prange(N):

X1 = 𝜒1grid[i, j]

X2 = 𝜒2grid[i, j]

k = root_finding.newton_secant(k_foc, 1e-2, args=(X1, X2)).root

kgrid[i, j] = k

%%time

fill_k_grid(kgrid)

CPU times: user 1.38 s, sys: 110 ms, total: 1.49 s

Wall time: 1.49 s

%%time

# Second-run

fill_k_grid(kgrid)

CPU times: user 8.33 ms, sys: 1.03 ms, total: 9.36 ms

Wall time: 2.5 ms

#=== Example: Plot optimal k with different correlations ===#

from IPython.display import Image

# Import plotly

import plotly.graph_objs as go

# Plot optimal k

fig = go.Figure(data=[go.Surface(x=𝜒1grid, y=𝜒2grid, z=kgrid)])

fig.update_layout(scene = dict(xaxis_title='x - 𝜒1',

yaxis_title='y - 𝜒2',

zaxis_title='z - k',

aspectratio=dict(x=1,y=1,z=1)))

fig.update_layout(width=500,

height=500,

margin=dict(l=50, r=50, b=65, t=90))

fig.update_layout(scene_camera=dict(eye=dict(x=2, y=-2, z=1.5)))

# Export to PNG file

Image(fig.to_image(format="png", engine="kaleido"))

# fig.show() will provide interactive plot when running

# notebook locally

/tmp/ipykernel_5948/855658286.py:19: DeprecationWarning:

Support for the 'engine' argument is deprecated and will be removed after September 2025.

Kaleido will be the only supported engine at that time.