47. Optimal Taxation without State-Contingent Debt#

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install --upgrade quantecon

47.1. Overview#

Let’s start with following imports:

import numpy as np

import matplotlib.pyplot as plt

from scipy.optimize import root

from quantecon import optimize, MarkovChain

from numba import njit, prange, float64

from numba.experimental import jitclass

Now let’s define numba-compatible interpolation functions for this lecture.

We will soon use the following interpolation functions to interpolate the value function and the policy functions

@njit

def get_grid_nodes(grid):

"""

Get the actual grid points from a grid tuple.

"""

x_min, x_max, x_num = grid

return np.linspace(x_min, x_max, x_num)

@njit

def linear_interp_1d_scalar(x_min, x_max, x_num, y_values, x_val):

"""Helper function for scalar interpolation"""

x_nodes = np.linspace(x_min, x_max, x_num)

# Extrapolation with linear extension

if x_val <= x_nodes[0]:

# Linear extrapolation using first two points

if x_num >= 2:

slope = (y_values[1] - y_values[0]) \

/ (x_nodes[1] - x_nodes[0])

return y_values[0] + slope * (x_val - x_nodes[0])

else:

return y_values[0]

if x_val >= x_nodes[-1]:

# Linear extrapolation using last two points

if x_num >= 2:

slope = (y_values[-1] - y_values[-2]) \

/ (x_nodes[-1] - x_nodes[-2])

return y_values[-1] + slope * (x_val - x_nodes[-1])

else:

return y_values[-1]

# Binary search for the right interval

left = 0

right = x_num - 1

while right - left > 1:

mid = (left + right) // 2

if x_nodes[mid] <= x_val:

left = mid

else:

right = mid

# Linear interpolation

x_left = x_nodes[left]

x_right = x_nodes[right]

y_left = y_values[left]

y_right = y_values[right]

weight = (x_val - x_left) / (x_right - x_left)

return y_left * (1 - weight) + y_right * weight

@njit

def linear_interp_1d(x_grid, y_values, x_query):

"""

Perform 1D linear interpolation.

"""

x_min, x_max, x_num = x_grid

return linear_interp_1d_scalar(x_min, x_max, x_num, y_values, x_query[0])

Let’s start with following imports:

In an earlier lecture, we described a model of optimal taxation with state-contingent debt due to Robert E. Lucas, Jr., and Nancy Stokey [Lucas and Stokey, 1983].

Aiyagari, Marcet, Sargent, and Seppälä [Aiyagari et al., 2002] (hereafter, AMSS) studied optimal taxation in a model without state-contingent debt.

In this lecture, we

describe assumptions and equilibrium concepts

solve the model

implement the model numerically

conduct some policy experiments

compare outcomes with those in a corresponding complete-markets model

We begin with an introduction to the model.

47.2. Competitive equilibrium with distorting taxes#

Many but not all features of the economy are identical to those of the Lucas-Stokey economy.

Let’s start with things that are identical.

For \(t \geq 0\), a history of the state is represented by \(s^t = [s_t, s_{t-1}, \ldots, s_0]\).

Government purchases \(g(s)\) are an exact time-invariant function of \(s\).

Let \(c_t(s^t)\), \(\ell_t(s^t)\), and \(n_t(s^t)\) denote consumption, leisure, and labor supply, respectively, at history \(s^t\) at time \(t\).

Each period a representative household is endowed with one unit of time that can be divided between leisure \(\ell_t\) and labor \(n_t\):

Output equals \(n_t(s^t)\) and can be divided between consumption \(c_t(s^t)\) and \(g(s_t)\)

Output is not storable.

The technology pins down a pre-tax wage rate to unity for all \(t, s^t\).

A representative household’s preferences over \(\{c_t(s^t), \ell_t(s^t)\}_{t=0}^\infty\) are ordered by

where

\(\pi_t(s^t)\) is a joint probability distribution over the sequence \(s^t\), and

the utility function \(u\) is increasing, strictly concave, and three times continuously differentiable in both arguments.

The government imposes a flat rate tax \(\tau_t(s^t)\) on labor income at time \(t\), history \(s^t\).

Lucas and Stokey assumed that there are complete markets in one-period Arrow securities; also see smoothing models.

It is at this point that AMSS [Aiyagari et al., 2002] modify the Lucas and Stokey economy.

AMSS allow the government to issue only one-period risk-free debt each period.

Ruling out complete markets in this way is a step in the direction of making total tax collections behave more like that prescribed in Robert Barro (1979) [Barro, 1979] than they do in Lucas and Stokey (1983) [Lucas and Stokey, 1983].

47.2.1. Risk-free one-period debt only#

In period \(t\) and history \(s^t\), let

\(b_{t+1}(s^t)\) be the amount of the time \(t+1\) consumption good that at time \(t\), history \(s^t\) the government promised to pay

\(R_t(s^t)\) be the gross interest rate on risk-free one-period debt between periods \(t\) and \(t+1\)

\(T_t(s^t)\) be a non-negative lump-sum transfer to the representative household [1]

That \(b_{t+1}(s^t)\) is the same for all realizations of \(s_{t+1}\) captures its risk-free character.

The market value at time \(t\) of government debt maturing at time \(t+1\) equals \(b_{t+1}(s^t)\) divided by \(R_t(s^t)\).

The government’s budget constraint in period \(t\) at history \(s^t\) is

where \(z_t(s^t)\) is the net-of-interest government surplus.

To rule out Ponzi schemes, we assume that the government is subject to a natural debt limit (to be discussed in a forthcoming lecture).

The consumption Euler equation for a representative household able to trade only one-period risk-free debt with one-period gross interest rate \(R_t(s^t)\) is

Substituting this expression into the government’s budget constraint (47.4) yields:

Components of \(z_t(s^t)\) on the right side depend on \(s^t\), but the left side is required to depend only on \(s^{t-1}\) .

This is what it means for one-period government debt to be risk-free.

Therefore, the right side of equation (47.5) also has to depend only on \(s^{t-1}\).

This requirement will give rise to measurability constraints on the Ramsey allocation to be discussed soon.

If we replace \(b_{t+1}(s^t)\) on the right side of equation (47.5) by the right side of next period’s budget constraint (associated with a particular realization \(s_{t}\)) we get

After making similar repeated substitutions for all future occurrences of government indebtedness, and by invoking a natural debt limit, we arrive at:

Notice how the conditioning sets in equation (47.6) differ: they are \(s^{t-1}\) on the left side and \(s^t\) on the right side.

Now let’s

substitute the resource constraint into the net-of-interest government surplus, and

use the household’s first-order condition \(1-\tau^n_t(s^t)= u_{\ell}(s^t) /u_c(s^t)\) to eliminate the labor tax rate

so that we can express the net-of-interest government surplus \(z_t(s^t)\) as

If we substitute appropriate versions of the right side of (47.7) for \(z_{t+j}(s^{t+j})\) into equation (47.6), we obtain a sequence of implementability constraints on a Ramsey allocation in an AMSS economy.

Expression (47.6) at time \(t=0\) and initial state \(s^0\) was also an implementability constraint on a Ramsey allocation in a Lucas-Stokey economy:

Indeed, it was the only implementability constraint there.

But now we also have a large number of additional implementability constraints

Equation (47.9) must hold for each \(s^t\) for each \(t \geq 1\).

47.2.2. Comparison with Lucas-Stokey economy#

The expression on the right side of (47.9) in the Lucas-Stokey (1983) economy would equal the present value of a continuation stream of government net-of-interest surpluses evaluated at what would be competitive equilibrium Arrow-Debreu prices at date \(t\).

In the Lucas-Stokey economy, that present value is measurable with respect to \(s^t\).

In the AMSS economy, the restriction that government debt be risk-free imposes that that same present value must be measurable with respect to \(s^{t-1}\).

In a language used in the literature on incomplete markets models, it can be said that the AMSS model requires that at each \((t, s^t)\) what would be the present value of continuation government net-of-interest surpluses in the Lucas-Stokey model must belong to the marketable subspace of the AMSS model.

47.2.3. Ramsey problem without state-contingent debt#

After we have substituted the resource constraint into the utility function, we can express the Ramsey problem as being to choose an allocation that solves

where the maximization is subject to

and

given \(b_0(s^{-1})\).

47.2.3.1. Lagrangian formulation#

Let \(\gamma_0(s^0)\) be a non-negative Lagrange multiplier on constraint (47.10).

As in the Lucas-Stokey economy, this multiplier is strictly positive when the government must resort to distortionary taxation; otherwise it equals zero.

A consequence of the assumption that there are no markets in state-contingent securities and that a market exists only in a risk-free security is that we have to attach a stochastic process \(\{\gamma_t(s^t)\}_{t=1}^\infty\) of Lagrange multipliers to the implementability constraints (47.11).

Depending on how the constraints bind, these multipliers can be positive or negative:

A negative multiplier \(\gamma_t(s^t)<0\) means that if we could relax constraint (47.11), we would like to increase the beginning-of-period indebtedness for that particular realization of history \(s^t\).

That would let us reduce the beginning-of-period indebtedness for some other history [2].

These features flow from the fact that the government cannot use state-contingent debt and therefore cannot allocate its indebtedness efficiently across future states.

47.2.4. Some calculations#

It is helpful to apply two transformations to the Lagrangian.

Multiply constraint (47.10) by \(u_c(s^0)\) and the constraints (47.11) by \(\beta^t u_c(s^{t})\).

Then a Lagrangian for the Ramsey problem can be represented as

where

In (47.12), the second equality uses the law of iterated expectations and Abel’s summation formula (also called summation by parts, see this page).

First-order conditions with respect to \(c_t(s^t)\) can be expressed as

and with respect to \(b_t(s^t)\) as

If we substitute \(z_t(s^t)\) from (47.7) and its derivative \(z_c(s^t)\) into the first-order condition (47.14), we find two differences from the corresponding condition for the optimal allocation in a Lucas-Stokey economy with state-contingent government debt.

The term involving \(b_t(s^{t-1})\) in the first-order condition (47.14) does not appear in the corresponding expression for the Lucas-Stokey economy.

This term reflects the constraint that beginning-of-period government indebtedness must be the same across all realizations of next period’s state, a constraint that would not be present if government debt could be state-contingent.

The Lagrange multiplier \(\Psi_t(s^t)\) in the first-order condition (47.14) may change over time in response to realizations of the state, while the multiplier \(\Phi\) in the Lucas-Stokey economy is time-invariant.

We need some code from an earlier lecture on optimal taxation with state-contingent debt sequential allocation implementation:

class SequentialLS:

'''

Class that takes a preference object, state transition matrix,

and state contingent government expenditure plan as inputs, and

solves the sequential allocation problem described above.

It returns optimal allocations about consumption and labor supply,

as well as the multiplier on the implementability constraint Φ.

'''

def __init__(self,

pref,

π=np.full((2, 2), 0.5),

g=np.array([0.1, 0.2])):

# Initialize from pref object attributes

self.β, self.π, self.g = pref.β, π, g

self.mc = MarkovChain(self.π)

self.S = len(π) # Number of states

self.pref = pref

# Find the first best allocation

self.find_first_best()

def FOC_first_best(self, c, g):

'''

First order conditions that characterize

the first best allocation.

'''

pref = self.pref

Uc, Ul = pref.Uc, pref.Ul

n = c + g

l = 1 - n

return Uc(c, l) - Ul(c, l)

def find_first_best(self):

'''

Find the first best allocation

'''

S, g = self.S, self.g

res = root(self.FOC_first_best, np.full(S, 0.5), args=(g,))

if (res.fun > 1e-10).any():

raise Exception('Could not find first best')

self.cFB = res.x

self.nFB = self.cFB + g

def FOC_time1(self, c, Φ, g):

'''

First order conditions that characterize

optimal time 1 allocation problems.

'''

pref = self.pref

Uc, Ucc, Ul, Ull, Ulc = pref.Uc, pref.Ucc, pref.Ul, pref.Ull, pref.Ulc

n = c + g

l = 1 - n

LHS = (1 + Φ) * Uc(c, l) + Φ * (c * Ucc(c, l) - n * Ulc(c, l))

RHS = (1 + Φ) * Ul(c, l) + Φ * (c * Ulc(c, l) - n * Ull(c, l))

diff = LHS - RHS

return diff

def time1_allocation(self, Φ):

'''

Computes optimal allocation for time t >= 1 for a given Φ

'''

pref = self.pref

S, g = self.S, self.g

# use the first best allocation as intial guess

res = root(self.FOC_time1, self.cFB, args=(Φ, g))

if (res.fun > 1e-10).any():

raise Exception('Could not find LS allocation.')

c = res.x

n = c + g

l = 1 - n

# Compute x

I = pref.Uc(c, n) * c - pref.Ul(c, l) * n

x = np.linalg.solve(np.eye(S) - self.β * self.π, I)

return c, n, x

def FOC_time0(self, c0, Φ, g0, b0):

'''

First order conditions that characterize

time 0 allocation problem.

'''

pref = self.pref

Ucc, Ulc = pref.Ucc, pref.Ulc

n0 = c0 + g0

l0 = 1 - n0

diff = self.FOC_time1(c0, Φ, g0)

diff -= Φ * (Ucc(c0, l0) - Ulc(c0, l0)) * b0

return diff

def implementability(self, Φ, b0, s0, cn0_arr):

'''

Compute the differences between the RHS and LHS

of the implementability constraint given Φ,

initial debt, and initial state.

'''

pref, π, g, β = self.pref, self.π, self.g, self.β

Uc, Ul = pref.Uc, pref.Ul

g0 = self.g[s0]

c, n, x = self.time1_allocation(Φ)

res = root(self.FOC_time0, cn0_arr[0], args=(Φ, g0, b0))

c0 = res.x

n0 = c0 + g0

l0 = 1 - n0

cn0_arr[:] = c0.item(), n0.item()

LHS = Uc(c0, l0) * b0

RHS = Uc(c0, l0) * c0 - Ul(c0, l0) * n0 + β * π[s0] @ x

return RHS - LHS

def time0_allocation(self, b0, s0):

'''

Finds the optimal time 0 allocation given

initial government debt b0 and state s0

'''

# use the first best allocation as initial guess

cn0_arr = np.array([self.cFB[s0], self.nFB[s0]])

res = root(self.implementability, 0., args=(b0, s0, cn0_arr))

if (res.fun > 1e-10).any():

raise Exception('Could not find time 0 LS allocation.')

Φ = res.x[0]

c0, n0 = cn0_arr

return Φ, c0, n0

def τ(self, c, n):

'''

Computes τ given c, n

'''

pref = self.pref

Uc, Ul = pref.Uc, pref.Ul

return 1 - Ul(c, 1-n) / Uc(c, 1-n)

def simulate(self, b0, s0, T, sHist=None):

'''

Simulates planners policies for T periods

'''

pref, π, β = self.pref, self.π, self.β

Uc = pref.Uc

if sHist is None:

sHist = self.mc.simulate(T, s0)

cHist, nHist, Bhist, τHist, ΦHist = np.empty((5, T))

RHist = np.empty(T-1)

# Time 0

Φ, cHist[0], nHist[0] = self.time0_allocation(b0, s0)

τHist[0] = self.τ(cHist[0], nHist[0])

Bhist[0] = b0

ΦHist[0] = Φ

# Time 1 onward

for t in range(1, T):

c, n, x = self.time1_allocation(Φ)

τ = self.τ(c, n)

u_c = Uc(c, 1-n)

s = sHist[t]

Eu_c = π[sHist[t-1]] @ u_c

cHist[t], nHist[t], Bhist[t], τHist[t] = c[s], n[s], x[s] / u_c[s], τ[s]

RHist[t-1] = Uc(cHist[t-1], 1-nHist[t-1]) / (β * Eu_c)

ΦHist[t] = Φ

gHist = self.g[sHist]

yHist = nHist

return [cHist, nHist, Bhist, τHist, gHist, yHist, sHist, ΦHist, RHist]

To analyze the AMSS model, we find it useful to adopt a recursive formulation using techniques like those in our lectures on dynamic Stackelberg models and optimal taxation with state-contingent debt.

47.3. Recursive version of AMSS model#

We now describe a recursive formulation of the AMSS economy.

We have noted that from the point of view of the Ramsey planner, the restriction to one-period risk-free securities

leaves intact the single implementability constraint on allocations (47.8) from the Lucas-Stokey economy, but

adds measurability constraints (47.6) on functions of tails of allocations at each time and history

We now explore how these constraints alter Bellman equations for a time \(0\) Ramsey planner and for time \(t \geq 1\), history \(s^t\) continuation Ramsey planners.

47.3.1. Recasting state variables#

In the AMSS setting, the government faces a sequence of budget constraints

where \(R_t(s^t)\) is the gross risk-free rate of interest between \(t\) and \(t+1\) at history \(s^t\) and \(T_t(s^t)\) are non-negative transfers.

Throughout this lecture, we shall set transfers to zero (for some issues about the limiting behavior of debt, this is possibly an important difference from AMSS [Aiyagari et al., 2002], who restricted transfers to be non-negative).

In this case, the household faces a sequence of budget constraints

The household’s first-order conditions are \(u_{c,t} = \beta R_t \mathbb E_t u_{c,t+1}\) and \((1-\tau_t) u_{c,t} = u_{l,t}\).

Using these to eliminate \(R_t\) and \(\tau_t\) from budget constraint (47.16) gives

or

Now define

and represent the household’s budget constraint at time \(t\), history \(s^t\) as

for \(t \geq 1\).

47.3.2. Measurability constraints#

Write equation (47.18) as

The right side of equation (47.21) expresses the time \(t\) value of government debt in terms of a linear combination of terms whose individual components are measurable with respect to \(s^t\).

The sum of terms on the right side of equation (47.21) must equal \(b_t(s^{t-1})\).

That implies that it has to be measurable with respect to \(s^{t-1}\).

Equations (47.21) are the measurability constraints that the AMSS model adds to the single time \(0\) implementation constraint imposed in the Lucas and Stokey model.

47.3.3. Two Bellman equations#

Let \(\Pi(s|s_-)\) be a Markov transition matrix whose entries tell probabilities of moving from state \(s_-\) to state \(s\) in one period.

Let

\(V(x_-, s_-)\) be the continuation value of a continuation Ramsey plan at \(x_{t-1} = x_-, s_{t-1} =s_-\) for \(t \geq 1\)

\(W(b, s)\) be the value of the Ramsey plan at time \(0\) at \(b_0=b\) and \(s_0 = s\)

We distinguish between two types of planners:

For \(t \geq 1\), the value function for a continuation Ramsey planner satisfies the Bellman equation

subject to the following collection of implementability constraints, one for each \(s \in {\cal S}\):

A continuation Ramsey planner at \(t \geq 1\) takes \((x_{t-1}, s_{t-1}) = (x_-, s_-)\) as given and before \(s\) is realized chooses \((n_t(s_t), x_t(s_t)) = (n(s), x(s))\) for \(s \in {\cal S}\).

The Ramsey planner takes \((b_0, s_0)\) as given and chooses \((n_0, x_0)\).

The value function \(W(b_0, s_0)\) for the time \(t=0\) Ramsey planner satisfies the Bellman equation

where maximization is subject to

47.3.4. Martingale supercedes state-variable degeneracy#

Let \(\mu(s|s_-) \Pi(s|s_-)\) be a Lagrange multiplier on the constraint (47.23) for state \(s\).

After forming an appropriate Lagrangian, we find that the continuation Ramsey planner’s first-order condition with respect to \(x(s)\) is

Applying an envelope theorem to Bellman equation (47.22) gives

Equations (47.26) and (47.27) imply that

Equation (47.28) states that \(V_x(x, s)\) is a risk-adjusted martingale.

Saying that \(V_x(x, s)\) is a risk-adjusted martingale means that \(V_x(x, s)\) is a martingale with respect to the probability distribution over \(s^t\) sequences that are generated by the twisted transition probability matrix:

Exercise 47.1

Please verify that \(\check \Pi(s|s_-)\) is a valid Markov transition density, i.e., that its elements are all non-negative and that for each \(s_-\), the sum over \(s\) equals unity.

47.3.5. Absence of state variable degeneracy#

Along a Ramsey plan, the state variable \(x_t = x_t(s^t, b_0)\) becomes a function of the history \(s^t\) and initial government debt \(b_0\).

In Lucas-Stokey model, we found that

a counterpart to \(V_x(x,s)\) is time-invariant and equal to the Lagrange multiplier on the Lucas-Stokey implementability constraint

time invariance of \(V_x(x,s)\) is the source of a key feature of the Lucas-Stokey model, namely, state variable degeneracy in which \(x_t\) is an exact time-invariant function of \(s_t\).

That \(V_x(x,s)\) varies over time according to a twisted martingale means that there is no state-variable degeneracy in the AMSS model.

In the AMSS model, both \(x\) and \(s\) are needed to describe the state.

This property of the AMSS model transmits a twisted martingale component to consumption, employment, and the tax rate.

47.3.6. Digression on non-negative transfers#

Throughout this lecture, we have imposed that transfers \(T_t = 0\).

AMSS [Aiyagari et al., 2002] instead imposed a nonnegativity constraint \(T_t\geq 0\) on transfers.

They also considered a special case of quasi-linear preferences, \(u(c,l)= c + H(l)\).

In this case, \(V_x(x,s)\leq 0\) is a non-positive martingale.

By the martingale convergence theorem \(V_x(x,s)\) converges almost surely.

Furthermore, when the Markov chain \(\Pi(s| s_-)\) and the government expenditure function \(g(s)\) are such that \(g_t\) is perpetually random, \(V_x(x, s)\) almost surely converges to zero.

For quasi-linear preferences, the first-order condition for maximizing (47.22) subject to (47.23) with respect to \(n(s)\) becomes

When \(\mu(s|s_-) = \beta V_x(x(s),x)\) converges to zero, in the limit \(u_l(s)= 1 =u_c(s)\), so that \(\tau(x(s),s) =0\).

Thus, in the limit, if \(g_t\) is perpetually random, the government accumulates sufficient assets to finance all expenditures from earnings on those assets, returning any excess revenues to the household as non-negative lump-sum transfers.

47.3.7. Code#

The recursive formulation is implemented as follows

import numpy as np

from numba import njit, prange

from quantecon import optimize

@njit

def get_grid_nodes(grid):

"""

Get the actual grid points from a grid tuple.

"""

x_min, x_max, x_num = grid

return np.linspace(x_min, x_max, x_num)

@njit

def linear_interp_1d_scalar(x_min, x_max, x_num, y_values, x_val):

"""Helper function for scalar interpolation"""

x_nodes = np.linspace(x_min, x_max, x_num)

# Extrapolation with linear extension

if x_val <= x_nodes[0]:

# Linear extrapolation using first two points

if x_num >= 2:

slope = (y_values[1] - y_values[0]) / (x_nodes[1] - x_nodes[0])

return y_values[0] + slope * (x_val - x_nodes[0])

else:

return y_values[0]

if x_val >= x_nodes[-1]:

# Linear extrapolation using last two points

if x_num >= 2:

slope = (y_values[-1] - y_values[-2]) / (x_nodes[-1] - x_nodes[-2])

return y_values[-1] + slope * (x_val - x_nodes[-1])

else:

return y_values[-1]

# Binary search for the right interval

left = 0

right = x_num - 1

while right - left > 1:

mid = (left + right) // 2

if x_nodes[mid] <= x_val:

left = mid

else:

right = mid

# Linear interpolation

x_left = x_nodes[left]

x_right = x_nodes[right]

y_left = y_values[left]

y_right = y_values[right]

weight = (x_val - x_left) / (x_right - x_left)

return y_left * (1 - weight) + y_right * weight

@njit

def linear_interp_1d(x_grid, y_values, x_query):

"""

Perform 1D linear interpolation.

"""

x_min, x_max, x_num = x_grid

return linear_interp_1d_scalar(x_min, x_max, x_num, y_values, x_query[0])

class AMSS:

# WARNING: THE CODE IS EXTREMELY SENSITIVE TO CHOCIES OF PARAMETERS.

# DO NOT CHANGE THE PARAMETERS AND EXPECT IT TO WORK

def __init__(self, pref, β, Π, g, x_grid, bounds_v):

self.β, self.Π, self.g = β, Π, g

self.x_grid = x_grid

self.n = x_grid[0][2]

self.S = len(Π)

self.bounds = bounds_v

self.pref = pref

self.T_v, self.T_w = bellman_operator_factory(Π, β, x_grid, g,

bounds_v)

self.V_solved = False

self.W_solved = False

def compute_V(self, V, σ_v_star, tol_vfi, maxitr, print_itr):

T_v = self.T_v

self.success = False

V_new = np.zeros_like(V)

Δ = 1.0

for itr in range(maxitr):

T_v(V, V_new, σ_v_star, self.pref)

Δ = np.max(np.abs(V_new - V))

if Δ < tol_vfi:

self.V_solved = True

print('Successfully completed VFI after %i iterations'

% (itr+1))

break

if (itr + 1) % print_itr == 0:

print('Error at iteration %i : ' % (itr + 1), Δ)

V[:] = V_new[:]

self.V = V

self.σ_v_star = σ_v_star

return V, σ_v_star

def compute_W(self, b_0, W, σ_w_star):

T_w = self.T_w

V = self.V

T_w(W, σ_w_star, V, b_0, self.pref)

self.W = W

self.σ_w_star = σ_w_star

self.W_solved = True

print('Succesfully solved the time 0 problem.')

return W, σ_w_star

def solve(self, V, σ_v_star, b_0, W, σ_w_star, tol_vfi=1e-7,

maxitr=1000, print_itr=10):

print("===============")

print("Solve time 1 problem")

print("===============")

self.compute_V(V, σ_v_star, tol_vfi, maxitr, print_itr)

print("===============")

print("Solve time 0 problem")

print("===============")

self.compute_W(b_0, W, σ_w_star)

def simulate(self, s_hist, b_0):

if not (self.V_solved and self.W_solved):

msg = "V and W need to be successfully computed before simulation."

raise ValueError(msg)

pref = self.pref

x_grid, g, β, S = self.x_grid, self.g, self.β, self.S

σ_v_star, σ_w_star = self.σ_v_star, self.σ_w_star

Π = self.Π

# Extract the grid tuple from the list

grid_tuple = x_grid[0] if isinstance(x_grid, list) else x_grid

T = len(s_hist)

s_0 = s_hist[0]

# Pre-allocate

n_hist = np.zeros(T)

x_hist = np.zeros(T)

c_hist = np.zeros(T)

τ_hist = np.zeros(T)

b_hist = np.zeros(T)

g_hist = np.zeros(T)

# Compute t = 0

l_0, T_0 = σ_w_star[s_0]

c_0 = (1 - l_0) - g[s_0]

x_0 = (-pref.Uc(c_0, l_0) * (c_0 - T_0 - b_0) +

pref.Ul(c_0, l_0) * (1 - l_0))

n_hist[0] = (1 - l_0)

x_hist[0] = x_0

c_hist[0] = c_0

τ_hist[0] = 1 - pref.Ul(c_0, l_0) / pref.Uc(c_0, l_0)

b_hist[0] = b_0

g_hist[0] = g[s_0]

# Compute t > 0

for t in range(T - 1):

x_ = x_hist[t]

s_ = s_hist[t]

l = np.zeros(S)

T = np.zeros(S)

for s in range(S):

x_arr = np.array([x_])

l[s] = linear_interp_1d(grid_tuple, σ_v_star[s_, :, s], x_arr)

T[s] = linear_interp_1d(grid_tuple, σ_v_star[s_, :, S+s], x_arr)

c = (1 - l) - g

u_c = pref.Uc(c, l)

Eu_c = Π[s_] @ u_c

x = u_c * x_ / (β * Eu_c) - u_c * (c - T) + pref.Ul(c, l) * (1 - l)

c_next = c[s_hist[t+1]]

l_next = l[s_hist[t+1]]

x_hist[t+1] = x[s_hist[t+1]]

n_hist[t+1] = 1 - l_next

c_hist[t+1] = c_next

τ_hist[t+1] = 1 - pref.Ul(c_next, l_next) / pref.Uc(c_next, l_next)

b_hist[t+1] = x_ / (β * Eu_c)

g_hist[t+1] = g[s_hist[t+1]]

return c_hist, n_hist, b_hist, τ_hist, g_hist, n_hist

def obj_factory(Π, β, x_grid, g):

S = len(Π)

# Extract the grid tuple from the list

grid_tuple = x_grid[0] if isinstance(x_grid, list) else x_grid

@njit

def obj_V(σ, state, V, pref):

# Unpack state

s_, x_ = state

l = σ[:S]

T = σ[S:]

c = (1 - l) - g

u_c = pref.Uc(c, l)

Eu_c = Π[s_] @ u_c

x = u_c * x_ / (β * Eu_c) - u_c * (c - T) + pref.Ul(c, l) * (1 - l)

V_next = np.zeros(S)

for s in range(S):

V_next[s] = linear_interp_1d(grid_tuple, V[s], np.array([x[s]]))

out = Π[s_] @ (pref.U(c, l) + β * V_next)

return out

@njit

def obj_W(σ, state, V, pref):

# Unpack state

s_, b_0 = state

l, T = σ

c = (1 - l) - g[s_]

x = -pref.Uc(c, l) * (c - T - b_0) + pref.Ul(c, l) * (1 - l)

V_next = linear_interp_1d(grid_tuple, V[s_], np.array([x]))

out = pref.U(c, l) + β * V_next

return out

return obj_V, obj_W

def bellman_operator_factory(Π, β, x_grid, g, bounds_v):

obj_V, obj_W = obj_factory(Π, β, x_grid, g)

# Extract the grid tuple from the list

grid_tuple = x_grid[0] if isinstance(x_grid, list) else x_grid

n = grid_tuple[2]

S = len(Π)

x_nodes = get_grid_nodes(grid_tuple)

@njit(parallel=True)

def T_v(V, V_new, σ_star, pref):

for s_ in prange(S):

for x_i in prange(n):

state = (s_, x_nodes[x_i])

x0 = σ_star[s_, x_i]

res = optimize.nelder_mead(obj_V, x0, bounds=bounds_v,

args=(state, V, pref))

if res.success:

V_new[s_, x_i] = res.fun

σ_star[s_, x_i] = res.x

else:

print("Optimization routine failed.")

bounds_w = np.array([[-9.0, 1.0], [0., 10.]])

def T_w(W, σ_star, V, b_0, pref):

for s_ in prange(S):

state = (s_, b_0)

x0 = σ_star[s_]

res = optimize.nelder_mead(obj_W, x0, bounds=bounds_w,

args=(state, V, pref))

W[s_] = res.fun

σ_star[s_] = res.x

return T_v, T_w

47.4. Examples#

We now turn to some examples.

47.4.1. Anticipated one-period war#

In our lecture on optimal taxation with state-contingent debt we studied how the government manages uncertainty in a simple setting.

As in that lecture, we assume the one-period utility function

Note

For convenience in matching our computer code, we have expressed utility as a function of \(n\) rather than leisure \(l\).

We first consider a government expenditure process that we studied earlier in a lecture on optimal taxation with state-contingent debt.

Government expenditures are known for sure in all periods except one.

For \(t<3\) or \(t > 3\) we assume that \(g_t = g_l = 0.1\).

At \(t = 3\) a war occurs with probability 0.5.

If there is war, \(g_3 = g_h = 0.2\).

If there is no war \(g_3 = g_l = 0.1\).

A useful trick is to define components of the state vector as the following six \((t,g)\) pairs:

We think of these 6 states as corresponding to \(s=1,2,3,4,5,6\).

The transition matrix is

The government expenditure at each state is

We assume the same utility parameters as in the Lucas-Stokey economy.

This utility function is implemented in the following class.

crra_util_data = [

('β', float64),

('σ', float64),

('γ', float64)

]

@jitclass(crra_util_data)

class CRRAutility:

def __init__(self,

β=0.9,

σ=2,

γ=2):

self.β, self.σ, self.γ = β, σ, γ

# Utility function

def U(self, c, l):

# Note: `l` should not be interpreted as labor, it is an auxiliary

# variable used to conveniently match the code and the equations

# in the lecture

σ = self.σ

if σ == 1.:

U = np.log(c)

else:

U = (c**(1 - σ) - 1) / (1 - σ)

return U - (1-l) ** (1 + self.γ) / (1 + self.γ)

# Derivatives of utility function

def Uc(self, c, l):

return c ** (-self.σ)

def Ucc(self, c, l):

return -self.σ * c ** (-self.σ - 1)

def Ul(self, c, l):

return (1-l) ** self.γ

def Ull(self, c, l):

return -self.γ * (1-l) ** (self.γ - 1)

def Ucl(self, c, l):

return 0

def Ulc(self, c, l):

return 0

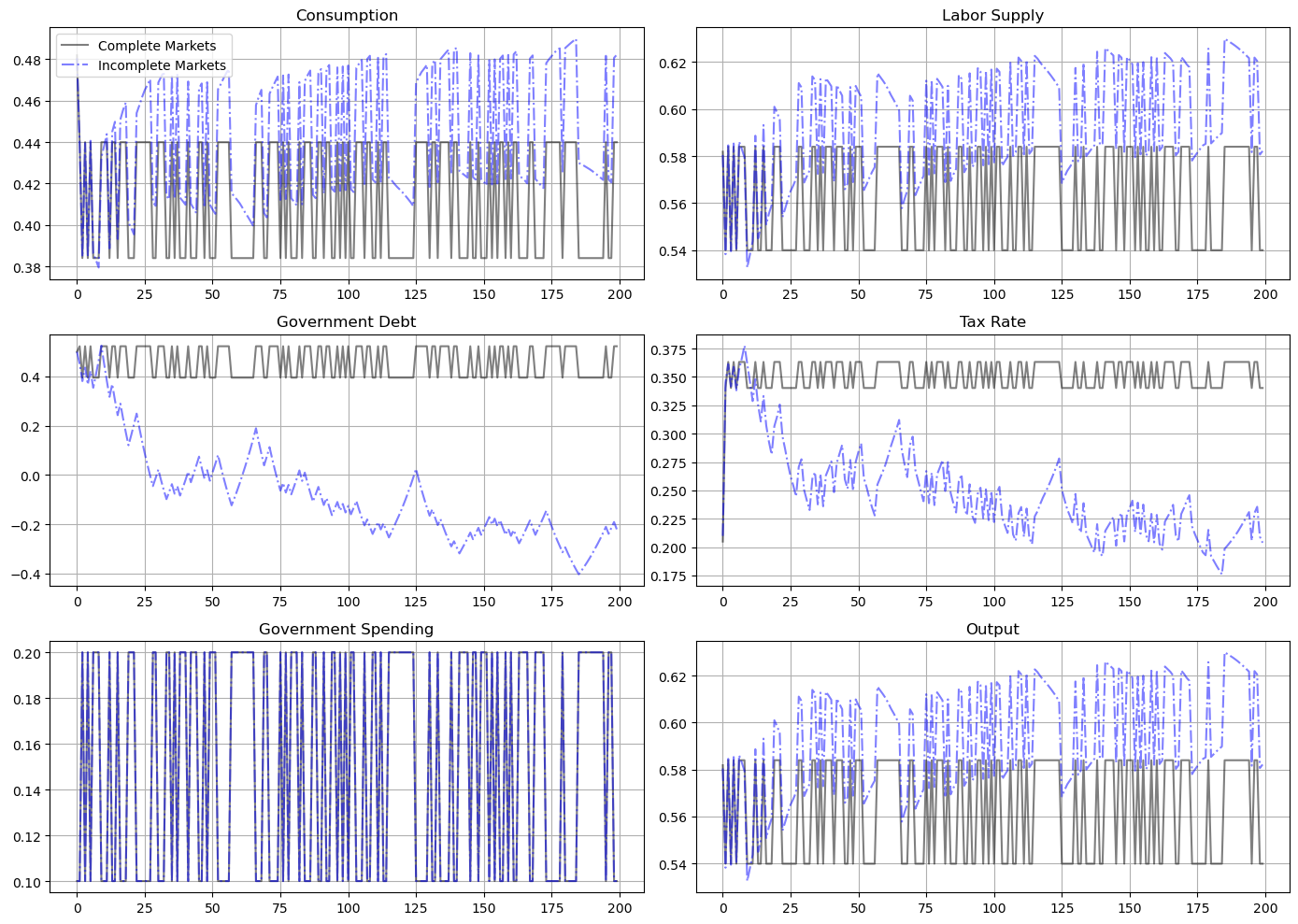

The following figure plots Ramsey plans under complete and incomplete markets for both possible realizations of the state at time \(t=3\).

Ramsey outcomes and policies when the government has access to state-contingent debt are represented by black lines and by red lines when there is only a risk-free bond.

Paths with circles are histories in which there is peace, while those with triangle denote war.

# WARNING: DO NOT EXPECT THE CODE TO WORK IF YOU CHANGE PARAMETERS

σ = 2

γ = 2

β = 0.9

Π = np.array([[0, 1, 0, 0, 0, 0],

[0, 0, 1, 0, 0, 0],

[0, 0, 0, 0.5, 0.5, 0],

[0, 0, 0, 0, 0, 1],

[0, 0, 0, 0, 0, 1],

[0, 0, 0, 0, 0, 1]])

g = np.array([0.1, 0.1, 0.1, 0.2, 0.1, 0.1])

x_min = -1.5555

x_max = 17.339

x_num = 300

x_grid = [(x_min, x_max, x_num)]

crra_pref = CRRAutility(β=β, σ=σ, γ=γ)

S = len(Π)

bounds_v = np.vstack([np.hstack([np.full(S, -10.), np.zeros(S)]),

np.hstack([np.ones(S) - g, np.full(S, 10.)])]).T

amss_model = AMSS(crra_pref, β, Π, g, x_grid, bounds_v)

# WARNING: DO NOT EXPECT THE CODE TO WORK IF YOU CHANGE PARAMETERS

V = np.zeros((len(Π), x_num))

V[:] = -get_grid_nodes(x_grid[0]) ** 2

σ_v_star = np.ones((S, x_num, S * 2))

σ_v_star[:, :, :S] = 0.0

W = np.empty(len(Π))

b_0 = 1.0

σ_w_star = np.ones((S, 2))

σ_w_star[:, 0] = -0.05

%%time

amss_model.solve(V, σ_v_star, b_0, W, σ_w_star)

===============

Solve time 1 problem

===============

Error at iteration 10 : 1.1100648401378521

Error at iteration 20 : 0.3078488587643786

Error at iteration 30 : 0.03221851531398201

Error at iteration 40 : 0.014347598008733087

Error at iteration 50 : 0.00312194446313363

Error at iteration 60 : 0.00107836473551437

Error at iteration 70 : 0.0003761255356202753

Error at iteration 80 : 0.0001318127597098595

Error at iteration 90 : 4.650031579700453e-05

Error at iteration 100 : 1.8013777079772808e-05

Error at iteration 110 : 6.175872597324883e-06

Error at iteration 120 : 2.445029183562042e-06

Error at iteration 130 : 1.0836745936160241e-06

Error at iteration 140 : 5.6828771199946e-07

Error at iteration 150 : 3.567560948880555e-07

Error at iteration 160 : 2.5837734796141376e-07

Error at iteration 170 : 2.0475366468986067e-07

Error at iteration 180 : 1.7066849622437985e-07

Error at iteration 190 : 1.4622036381695125e-07

Error at iteration 200 : 1.2738777854792716e-07

Error at iteration 210 : 1.1226231499961159e-07

Successfully completed VFI after 220 iterations

===============

Solve time 0 problem

===============

Succesfully solved the time 0 problem.

CPU times: user 2min 50s, sys: 2.1 s, total: 2min 52s

Wall time: 1min 13s

# Solve the LS model

ls_model = SequentialLS(crra_pref, g=g, π=Π)

# WARNING: DO NOT EXPECT THE CODE TO WORK IF YOU CHANGE PARAMETERS

s_hist_h = np.array([0, 1, 2, 3, 5, 5, 5])

s_hist_l = np.array([0, 1, 2, 4, 5, 5, 5])

sim_h_amss = amss_model.simulate(s_hist_h, b_0)

sim_l_amss = amss_model.simulate(s_hist_l, b_0)

sim_h_ls = ls_model.simulate(b_0, 0, 7, s_hist_h)

sim_l_ls = ls_model.simulate(b_0, 0, 7, s_hist_l)

fig, axes = plt.subplots(3, 2, figsize=(14, 10))

titles = ['Consumption', 'Labor Supply', 'Government Debt',

'Tax Rate', 'Government Spending', 'Output']

for ax, title, ls_l, ls_h, amss_l, amss_h in zip(axes.flatten(), titles,

sim_l_ls, sim_h_ls,

sim_l_amss, sim_h_amss):

ax.plot(ls_l, '-ok', ls_h, '-^k', amss_l, '-or', amss_h, '-^r',

alpha=0.7)

ax.set(title=title)

ax.grid()

plt.tight_layout()

plt.show()

How a Ramsey planner responds to war depends on the structure of the asset market.

If it is able to trade state-contingent debt, then at time \(t=2\)

the government purchases an Arrow security that pays off when \(g_3 = g_h\)

the government sells an Arrow security that pays off when \(g_3 = g_l\)

the Ramsey planner designs these purchases and sales designed so that, regardless of whether or not there is a war at \(t=3\), the government begins period \(t=4\) with the same government debt

This pattern facilities smoothing tax rates across states.

The government without state-contingent debt cannot do this.

Instead, it must enter time \(t=3\) with the same level of debt falling due whether there is peace or war at \(t=3\).

The risk-free rate between time \(2\) and time \(3\) is unusually low because at time \(2\) consumption at time \(3\) is expected to be unusually low.

A low risk-free rate of return on government debt between time \(2\) and time \(3\) allows the government to enter period \(3\) with lower government debt than it entered period \(2\).

To finance a war at time \(3\) it raises taxes and issues more debt to carry into perpetual peace that begins in period \(4\).

To service the additional debt burden, it raises taxes in all future periods.

The absence of state-contingent debt leads to an important difference in the optimal tax policy.

When the Ramsey planner has access to state-contingent debt, the optimal tax policy is history independent

the tax rate is a function of the current level of government spending only, given the Lagrange multiplier on the implementability constraint

Without state-contingent debt, the optimal tax rate is history dependent.

A war at time \(t=3\) causes a permanent increase in the tax rate.

Peace at time \(t=3\) causes a permanent reduction in the tax rate.

47.4.1.1. Perpetual war alert#

History dependence occurs more dramatically in a case in which the government perpetually faces the prospect of war.

This case was studied in the final example of the lecture on optimal taxation with state-contingent debt.

There, each period the government faces a constant probability, \(0.5\), of war.

In addition, this example features the following preferences

In accordance, we will re-define our utility function.

log_util_data = [

('β', float64),

('ψ', float64)

]

@jitclass(log_util_data)

class LogUtility:

def __init__(self,

β=0.9,

ψ=0.69):

self.β, self.ψ = β, ψ

# Utility function

def U(self, c, l):

return np.log(c) + self.ψ * np.log(l)

# Derivatives of utility function

def Uc(self, c, l):

return 1 / c

def Ucc(self, c, l):

return -c**(-2)

def Ul(self, c, l):

return self.ψ / l

def Ull(self, c, l):

return -self.ψ / l**2

def Ucl(self, c, l):

return 0

def Ulc(self, c, l):

return 0

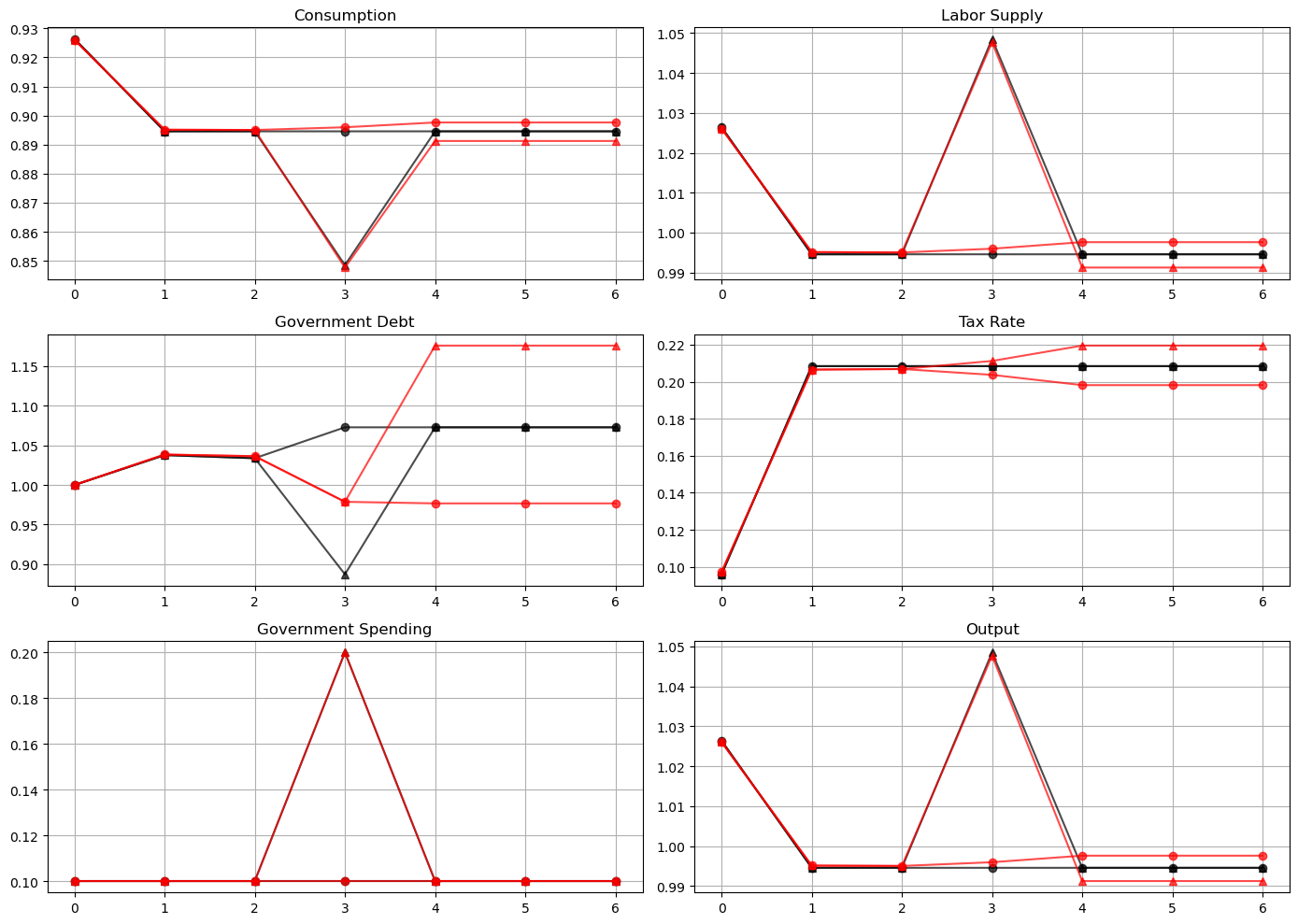

With these preferences, Ramsey tax rates will vary even in the Lucas-Stokey model with state-contingent debt.

The figure below plots optimal tax policies for both the economy with state-contingent debt (circles) and the economy with only a risk-free bond (triangles).

# WARNING: DO NOT EXPECT THE CODE TO WORK IF YOU CHANGE PARAMETERS

ψ = 0.69

Π = np.full((2, 2), 0.5)

β = 0.9

g = np.array([0.1, 0.2])

x_min = -3.4107

x_max = 3.709

x_num = 300

x_grid = [(x_min, x_max, x_num)]

log_pref = LogUtility(β=β, ψ=ψ)

S = len(Π)

bounds_v = np.vstack([np.zeros(2 * S), np.hstack([1 - g, np.ones(S)]) ]).T

V = np.zeros((len(Π), x_num))

V[:] = -(get_grid_nodes(x_grid[0]) + x_max) ** 2 / 14

σ_v_star = 1 - np.full((S, x_num, S * 2), 0.55)

W = np.empty(len(Π))

b_0 = 0.5

σ_w_star = 1 - np.full((S, 2), 0.55)

amss_model = AMSS(log_pref, β, Π, g, x_grid, bounds_v)

%%time

amss_model.solve(V, σ_v_star, b_0, W, σ_w_star, tol_vfi=3e-5, maxitr=3000,

print_itr=100)

===============

Solve time 1 problem

===============

Error at iteration 100 : 0.001156912305173563

Error at iteration 200 : 0.0005024950334071576

Error at iteration 300 : 0.0002995618583927495

Error at iteration 400 : 0.00020755613888212565

Error at iteration 500 : 0.00015558458529163488

Error at iteration 600 : 0.00012279319674135536

Error at iteration 700 : 0.00010068073823887858

Error at iteration 800 : 8.470541148142274e-05

Error at iteration 900 : 7.284396057016806e-05

Error at iteration 1000 : 6.370146950018807e-05

Error at iteration 1100 : 5.646858935470789e-05

Error at iteration 1200 : 5.048391475170888e-05

Error at iteration 1300 : 4.564400250117728e-05

Error at iteration 1400 : 4.146706198682182e-05

Error at iteration 1500 : 3.805415133761869e-05

Error at iteration 1600 : 3.521425495733865e-05

Error at iteration 1700 : 3.262771505951889e-05

Error at iteration 1800 : 3.0383804183742313e-05

Successfully completed VFI after 1819 iterations

===============

Solve time 0 problem

===============

Succesfully solved the time 0 problem.

CPU times: user 2min, sys: 4.93 s, total: 2min 5s

Wall time: 1min 8s

ls_model = SequentialLS(log_pref, g=g, π=Π) # Solve sequential problem

# WARNING: DO NOT EXPECT THE CODE TO WORK IF YOU CHANGE PARAMETERS

s_hist = np.array([0, 0, 0, 0, 0, 0, 0, 0, 1, 1,

0, 0, 0, 1, 1, 1, 1, 1, 1, 0])

T = len(s_hist)

sim_amss = amss_model.simulate(s_hist, b_0)

sim_ls = ls_model.simulate(0.5, 0, T, s_hist)

titles = ['Consumption', 'Labor Supply', 'Government Debt',

'Tax Rate', 'Government Spending', 'Output']

fig, axes = plt.subplots(3, 2, figsize=(14, 10))

for ax, title, ls, amss in zip(axes.flatten(), titles, sim_ls, sim_amss):

ax.plot(ls, '-ok', amss, '-^b')

ax.set(title=title)

ax.grid()

axes[0, 0].legend(('Complete Markets', 'Incomplete Markets'))

plt.tight_layout()

plt.show()

When the government experiences a prolonged period of peace, it is able to reduce government debt and set persistently lower tax rates.

However, the government finances a long war by borrowing and raising taxes.

This results in a drift away from policies with state-contingent debt that depends on the history of shocks.

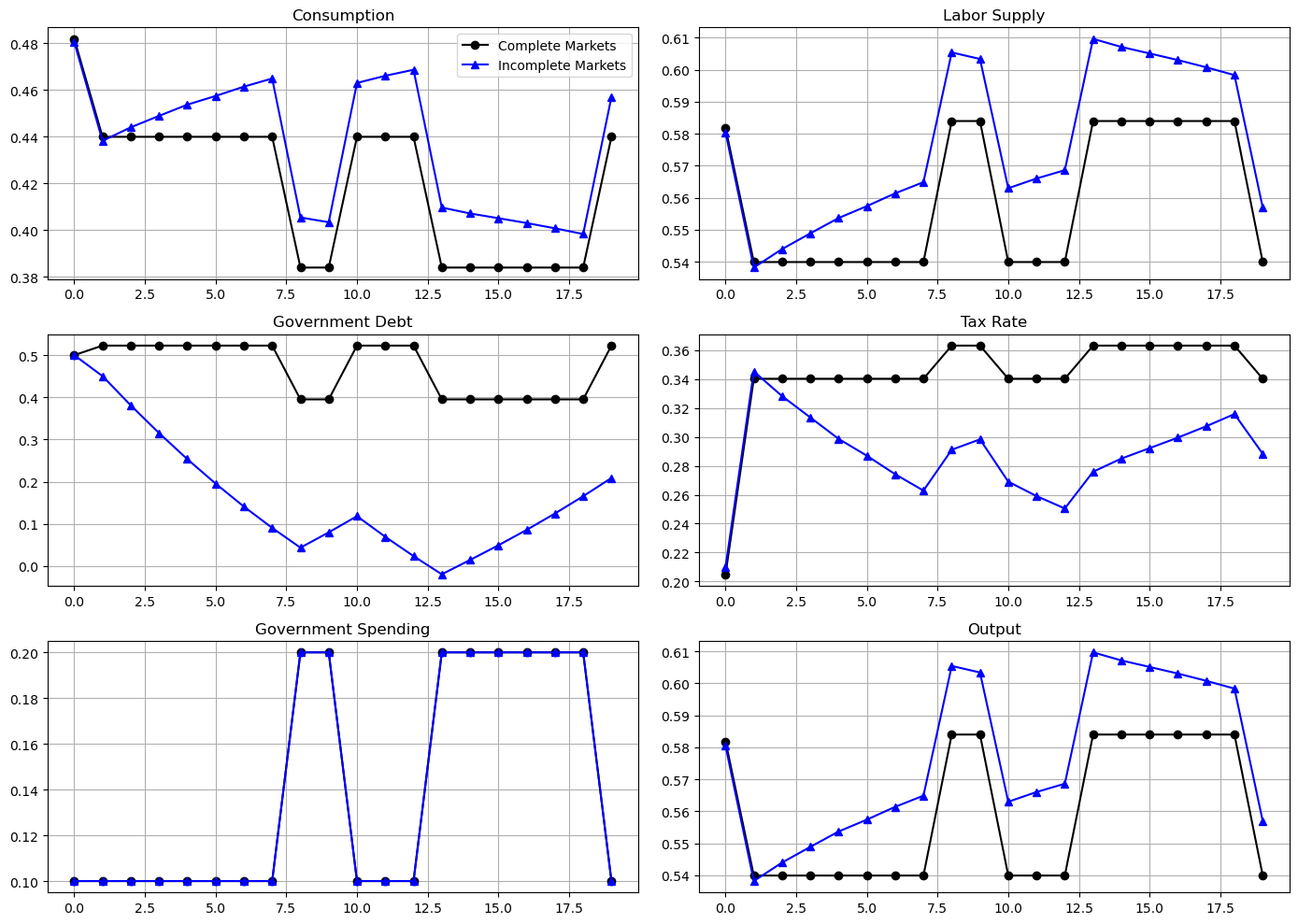

This is even more evident in the following figure that plots the evolution of the two policies over 200 periods.

This outcome reflects the presence of a force for precautionary saving that the incomplete markets structure imparts to the Ramsey plan.

In this subsequent lecture and this subsequent lecture, some ultimate consequences of that force are explored.

T = 200

s_0 = 0

mc = MarkovChain(Π)

s_hist_long = mc.simulate(T, init=s_0, random_state=5)

sim_amss = amss_model.simulate(s_hist_long, b_0)

sim_ls = ls_model.simulate(0.5, 0, T, s_hist_long)

titles = ['Consumption', 'Labor Supply', 'Government Debt',

'Tax Rate', 'Government Spending', 'Output']

fig, axes = plt.subplots(3, 2, figsize=(14, 10))

for ax, title, ls, amss in zip(axes.flatten(), titles, sim_ls, \

sim_amss):

ax.plot(ls, '-k', amss, '-.b', alpha=0.5)

ax.set(title=title)

ax.grid()

axes[0, 0].legend(('Complete Markets','Incomplete Markets'))

plt.tight_layout()

plt.show()