14. Globalization and Cycles#

14.1. Overview#

In this lecture, we review the paper Globalization and Synchronization of Innovation Cycles by Kiminori Matsuyama, Laura Gardini and Iryna Sushko.

This model helps us understand several interesting stylized facts about the world economy.

One of these is synchronized business cycles across different countries.

Most existing models that generate synchronized business cycles do so by assumption, since they tie output in each country to a common shock.

They also fail to explain certain features of the data, such as the fact that the degree of synchronization tends to increase with trade ties.

By contrast, in the model we consider in this lecture, synchronization is both endogenous and increasing with the extent of trade integration.

In particular, as trade costs fall and international competition increases, innovation incentives become aligned and countries synchronize their innovation cycles.

Let’s start with some imports:

import numpy as np

import matplotlib.pyplot as plt

from numba import jit

from ipywidgets import interact

14.1.1. Background#

The model builds on work by Judd [Judd, 1985], Deneckner and Judd [Deneckere and Judd, 1992] and Helpman and Krugman [Helpman and Krugman, 1985] by developing a two-country model with trade and innovation.

On the technical side, the paper introduces the concept of coupled oscillators to economic modeling.

As we will see, coupled oscillators arise endogenously within the model.

Below we review the model and replicate some of the results on synchronization of innovation across countries.

14.2. Key ideas#

It is helpful to begin with an overview of the mechanism.

14.2.1. Innovation cycles#

As discussed above, two countries produce and trade with each other.

In each country, firms innovate, producing new varieties of goods and, in doing so, receiving temporary monopoly power.

Imitators follow and, after one period of monopoly, what had previously been new varieties now enter competitive production.

Firms have incentives to innovate and produce new goods when the mass of varieties of goods currently in production is relatively low.

In addition, there are strategic complementarities in the timing of innovation.

Firms have incentives to innovate in the same period, so as to avoid competing with substitutes that are competitively produced.

This leads to temporal clustering in innovations in each country.

After a burst of innovation, the mass of goods currently in production increases.

However, goods also become obsolete, so that not all survive from period to period.

This mechanism generates a cycle, where the mass of varieties increases through simultaneous innovation and then falls through obsolescence.

14.2.2. Synchronization#

In the absence of trade, the timing of innovation cycles in each country is decoupled.

This will be the case when trade costs are prohibitively high.

If trade costs fall, then goods produced in each country penetrate each other’s markets.

As illustrated below, this leads to synchronization of business cycles across the two countries.

14.3. Model#

Let’s write down the model more formally.

(The treatment is relatively terse since full details can be found in the original paper)

Time is discrete with \(t = 0, 1, \dots\).

There are two countries indexed by \(j\) or \(k\).

In each country, a representative household inelastically supplies \(L_j\) units of labor at wage rate \(w_{j, t}\).

Without loss of generality, it is assumed that \(L_{1} \geq L_{2}\).

Households consume a single nontradeable final good which is produced competitively.

Its production involves combining two types of tradeable intermediate inputs via

Here \(X^o_{k, t}\) is a homogeneous input which can be produced from labor using a linear, one-for-one technology.

It is freely tradeable, competitively supplied, and homogeneous across countries.

By choosing the price of this good as numeraire and assuming both countries find it optimal to always produce the homogeneous good, we can set \(w_{1, t} = w_{2, t} = 1\).

The good \(X_{k, t}\) is a composite, built from many differentiated goods via

Here \(x_{k, t}(\nu)\) is the total amount of a differentiated good \(\nu \in \Omega_t\) that is produced.

The parameter \(\sigma > 1\) is the direct partial elasticity of substitution between a pair of varieties and \(\Omega_t\) is the set of varieties available in period \(t\).

We can split the varieties into those which are supplied competitively and those supplied monopolistically; that is, \(\Omega_t = \Omega_t^c + \Omega_t^m\).

14.3.1. Prices#

Demand for differentiated inputs is

Here

\(p_{k, t}(\nu)\) is the price of the variety \(\nu\) and

\(P_{k, t}\) is the price index for differentiated inputs in \(k\), defined by

The price of a variety also depends on the origin, \(j\), and destination, \(k\), of the goods because shipping varieties between countries incurs an iceberg trade cost \(\tau_{j,k}\).

Thus the effective price in country \(k\) of a variety \(\nu\) produced in country \(j\) becomes \(p_{k, t}(\nu) = \tau_{j,k} \, p_{j, t}(\nu)\).

Using these expressions, we can derive the total demand for each variety, which is

where

It is assumed that \(\tau_{1,1} = \tau_{2,2} = 1\) and \(\tau_{1,2} = \tau_{2,1} = \tau\) for some \(\tau > 1\), so that

The value \(\rho \in [0, 1)\) is a proxy for the degree of globalization.

Producing one unit of each differentiated variety requires \(\psi\) units of labor, so the marginal cost is equal to \(\psi\) for \(\nu \in \Omega_{j, t}\).

Additionally, all competitive varieties will have the same price (because of equal marginal cost), which means that, for all \(\nu \in \Omega^c\),

Monopolists will have the same marked-up price, so, for all \(\nu \in \Omega^m\) ,

Define

Using the preceding definitions and some algebra, the price indices can now be rewritten as

The symbols \(N_{j, t}^c\) and \(N_{j, t}^m\) will denote the measures of \(\Omega^c\) and \(\Omega^m\) respectively.

14.3.2. New varieties#

To introduce a new variety, a firm must hire \(f\) units of labor per variety in each country.

Monopolist profits must be less than or equal to zero in expectation, so

With further manipulations, this becomes

14.3.3. Law of motion#

With \(\delta\) as the exogenous probability of a variety becoming obsolete, the dynamic equation for the measure of firms becomes

We will work with a normalized measure of varieties

We also use \(s_j := \frac{L_j}{L_1 + L_2}\) to be the share of labor employed in country \(j\).

We can use these definitions and the preceding expressions to obtain a law of motion for \(n_t := (n_{1, t}, n_{2, t})\).

In particular, given an initial condition, \(n_0 = (n_{1, 0}, n_{2, 0}) \in \mathbb{R}_{+}^{2}\), the equilibrium trajectory, \(\{ n_t \}_{t=0}^{\infty} = \{ (n_{1, t}, n_{2, t}) \}_{t=0}^{\infty}\), is obtained by iterating on \(n_{t+1} = F(n_t)\) where \(F : \mathbb{R}_{+}^{2} \rightarrow \mathbb{R}_{+}^{2}\) is given by

Here

while

and \(h_j(n_k)\) is defined implicitly by the equation

Rewriting the equation above gives us a quadratic equation in terms of \(h_j(n_k)\).

Since we know \(h_j(n_k) > 0\) then we can just solve the quadratic equation and return the positive root.

This gives us

14.4. Simulation#

Let’s try simulating some of these trajectories.

We will focus in particular on whether or not innovation cycles synchronize across the two countries.

As we will see, this depends on initial conditions.

For some parameterizations, synchronization will occur for “most” initial conditions, while for others synchronization will be rare.

The computational burden of testing synchronization across many initial conditions is not trivial.

In order to make our code fast, we will use just in time compiled functions that will get called and handled by our class.

These are the @jit statements that you see below (review this lecture if you don’t recall how to use JIT compilation).

Here’s the main body of code

@jit(nopython=True)

def _hj(j, nk, s1, s2, θ, δ, ρ):

"""

If we expand the implicit function for h_j(n_k) then we find that

it is quadratic. We know that h_j(n_k) > 0 so we can get its

value by using the quadratic form

"""

# Find out who's h we are evaluating

if j == 1:

sj = s1

sk = s2

else:

sj = s2

sk = s1

# Coefficients on the quadratic a x^2 + b x + c = 0

a = 1.0

b = ((ρ + 1 / ρ) * nk - sj - sk)

c = (nk * nk - (sj * nk) / ρ - sk * ρ * nk)

# Positive solution of quadratic form

root = (-b + np.sqrt(b * b - 4 * a * c)) / (2 * a)

return root

@jit(nopython=True)

def DLL(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

"Determine whether (n1, n2) is in the set DLL"

return (n1 <= s1_ρ) and (n2 <= s2_ρ)

@jit(nopython=True)

def DHH(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

"Determine whether (n1, n2) is in the set DHH"

return (n1 >= _hj(1, n2, s1, s2, θ, δ, ρ)) and \

(n2 >= _hj(2, n1, s1, s2, θ, δ, ρ))

@jit(nopython=True)

def DHL(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

"Determine whether (n1, n2) is in the set DHL"

return (n1 >= s1_ρ) and (n2 <= _hj(2, n1, s1, s2, θ, δ, ρ))

@jit(nopython=True)

def DLH(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

"Determine whether (n1, n2) is in the set DLH"

return (n1 <= _hj(1, n2, s1, s2, θ, δ, ρ)) and (n2 >= s2_ρ)

@jit(nopython=True)

def one_step(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

"""

Takes a current value for (n_{1, t}, n_{2, t}) and returns the

values (n_{1, t+1}, n_{2, t+1}) according to the law of motion.

"""

# Depending on where we are, evaluate the right branch

if DLL(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

n1_tp1 = δ * (θ * s1_ρ + (1 - θ) * n1)

n2_tp1 = δ * (θ * s2_ρ + (1 - θ) * n2)

elif DHH(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

n1_tp1 = δ * n1

n2_tp1 = δ * n2

elif DHL(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

n1_tp1 = δ * n1

n2_tp1 = δ * (θ * _hj(2, n1, s1, s2, θ, δ, ρ) + (1 - θ) * n2)

elif DLH(n1, n2, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

n1_tp1 = δ * (θ * _hj(1, n2, s1, s2, θ, δ, ρ) + (1 - θ) * n1)

n2_tp1 = δ * n2

return n1_tp1, n2_tp1

@jit(nopython=True)

def n_generator(n1_0, n2_0, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ):

"""

Given an initial condition, continues to yield new values of

n1 and n2

"""

n1_t, n2_t = n1_0, n2_0

while True:

n1_tp1, n2_tp1 = one_step(n1_t, n2_t, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ)

yield (n1_tp1, n2_tp1)

n1_t, n2_t = n1_tp1, n2_tp1

@jit(nopython=True)

def _pers_till_sync(n1_0, n2_0, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ, maxiter, npers):

"""

Takes initial values and iterates forward to see whether

the histories eventually end up in sync.

If countries are symmetric then as soon as the two countries have the

same measure of firms then they will be synchronized -- However, if

they are not symmetric then it is possible they have the same measure

of firms but are not yet synchronized. To address this, we check whether

firms stay synchronized for `npers` periods with Euclidean norm

Parameters

----------

n1_0 : scalar(Float)

Initial normalized measure of firms in country one

n2_0 : scalar(Float)

Initial normalized measure of firms in country two

maxiter : scalar(Int)

Maximum number of periods to simulate

npers : scalar(Int)

Number of periods we would like the countries to have the

same measure for

Returns

-------

synchronized : scalar(Bool)

Did the two economies end up synchronized

pers_2_sync : scalar(Int)

The number of periods required until they synchronized

"""

# Initialize the status of synchronization

synchronized = False

pers_2_sync = maxiter

iters = 0

# Initialize generator

n_gen = n_generator(n1_0, n2_0, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ)

# Will use a counter to determine how many times in a row

# the firm measures are the same

nsync = 0

while (not synchronized) and (iters < maxiter):

# Increment the number of iterations and get next values

iters += 1

n1_t, n2_t = next(n_gen)

# Check whether same in this period

if abs(n1_t - n2_t) < 1e-8:

nsync += 1

# If not, then reset the nsync counter

else:

nsync = 0

# If we have been in sync for npers then stop and countries

# became synchronized nsync periods ago

if nsync > npers:

synchronized = True

pers_2_sync = iters - nsync

return synchronized, pers_2_sync

@jit(nopython=True)

def _create_attraction_basis(s1_ρ, s2_ρ, s1, s2, θ, δ, ρ,

maxiter, npers, npts):

# Create unit range with npts

synchronized, pers_2_sync = False, 0

unit_range = np.linspace(0.0, 1.0, npts)

# Allocate space to store time to sync

time_2_sync = np.empty((npts, npts))

# Iterate over initial conditions

for (i, n1_0) in enumerate(unit_range):

for (j, n2_0) in enumerate(unit_range):

synchronized, pers_2_sync = _pers_till_sync(n1_0, n2_0, s1_ρ,

s2_ρ, s1, s2, θ, δ,

ρ, maxiter, npers)

time_2_sync[i, j] = pers_2_sync

return time_2_sync

# == Now we define a class for the model == #

class MSGSync:

"""

The paper "Globalization and Synchronization of Innovation Cycles" presents

a two-country model with endogenous innovation cycles. Combines elements

from Deneckere Judd (1985) and Helpman Krugman (1985) to allow for a

model with trade that has firms who can introduce new varieties into

the economy.

We focus on being able to determine whether the two countries eventually

synchronize their innovation cycles. To do this, we only need a few

of the many parameters. In particular, we need the parameters listed

below

Parameters

----------

s1 : scalar(Float)

Amount of total labor in country 1 relative to total worldwide labor

θ : scalar(Float)

A measure of how much more of the competitive variety is used in

production of final goods

δ : scalar(Float)

Percentage of firms that are not exogenously destroyed every period

ρ : scalar(Float)

Measure of how expensive it is to trade between countries

"""

def __init__(self, s1=0.5, θ=2.5, δ=0.7, ρ=0.2):

# Store model parameters

self.s1, self.θ, self.δ, self.ρ = s1, θ, δ, ρ

# Store other cutoffs and parameters we use

self.s2 = 1 - s1

self.s1_ρ = self._calc_s1_ρ()

self.s2_ρ = 1 - self.s1_ρ

def _unpack_params(self):

return self.s1, self.s2, self.θ, self.δ, self.ρ

def _calc_s1_ρ(self):

# Unpack params

s1, s2, θ, δ, ρ = self._unpack_params()

# s_1(ρ) = min(val, 1)

val = (s1 - ρ * s2) / (1 - ρ)

return min(val, 1)

def simulate_n(self, n1_0, n2_0, T):

"""

Simulates the values of (n1, n2) for T periods

Parameters

----------

n1_0 : scalar(Float)

Initial normalized measure of firms in country one

n2_0 : scalar(Float)

Initial normalized measure of firms in country two

T : scalar(Int)

Number of periods to simulate

Returns

-------

n1 : Array(Float64, ndim=1)

A history of normalized measures of firms in country one

n2 : Array(Float64, ndim=1)

A history of normalized measures of firms in country two

"""

# Unpack parameters

s1, s2, θ, δ, ρ = self._unpack_params()

s1_ρ, s2_ρ = self.s1_ρ, self.s2_ρ

# Allocate space

n1 = np.empty(T)

n2 = np.empty(T)

# Create the generator

n1[0], n2[0] = n1_0, n2_0

n_gen = n_generator(n1_0, n2_0, s1_ρ, s2_ρ, s1, s2, θ, δ, ρ)

# Simulate for T periods

for t in range(1, T):

# Get next values

n1_tp1, n2_tp1 = next(n_gen)

# Store in arrays

n1[t] = n1_tp1

n2[t] = n2_tp1

return n1, n2

def pers_till_sync(self, n1_0, n2_0, maxiter=500, npers=3):

"""

Takes initial values and iterates forward to see whether

the histories eventually end up in sync.

If countries are symmetric then as soon as the two countries have the

same measure of firms then they will be synchronized -- However, if

they are not symmetric then it is possible they have the same measure

of firms but are not yet synchronized. To address this, we check whether

firms stay synchronized for `npers` periods with Euclidean norm

Parameters

----------

n1_0 : scalar(Float)

Initial normalized measure of firms in country one

n2_0 : scalar(Float)

Initial normalized measure of firms in country two

maxiter : scalar(Int)

Maximum number of periods to simulate

npers : scalar(Int)

Number of periods we would like the countries to have the

same measure for

Returns

-------

synchronized : scalar(Bool)

Did the two economies end up synchronized

pers_2_sync : scalar(Int)

The number of periods required until they synchronized

"""

# Unpack parameters

s1, s2, θ, δ, ρ = self._unpack_params()

s1_ρ, s2_ρ = self.s1_ρ, self.s2_ρ

return _pers_till_sync(n1_0, n2_0, s1_ρ, s2_ρ,

s1, s2, θ, δ, ρ, maxiter, npers)

def create_attraction_basis(self, maxiter=250, npers=3, npts=50):

"""

Creates an attraction basis for values of n on [0, 1] X [0, 1]

with npts in each dimension

"""

# Unpack parameters

s1, s2, θ, δ, ρ = self._unpack_params()

s1_ρ, s2_ρ = self.s1_ρ, self.s2_ρ

ab = _create_attraction_basis(s1_ρ, s2_ρ, s1, s2, θ, δ,

ρ, maxiter, npers, npts)

return ab

14.4.1. Time series of firm measures#

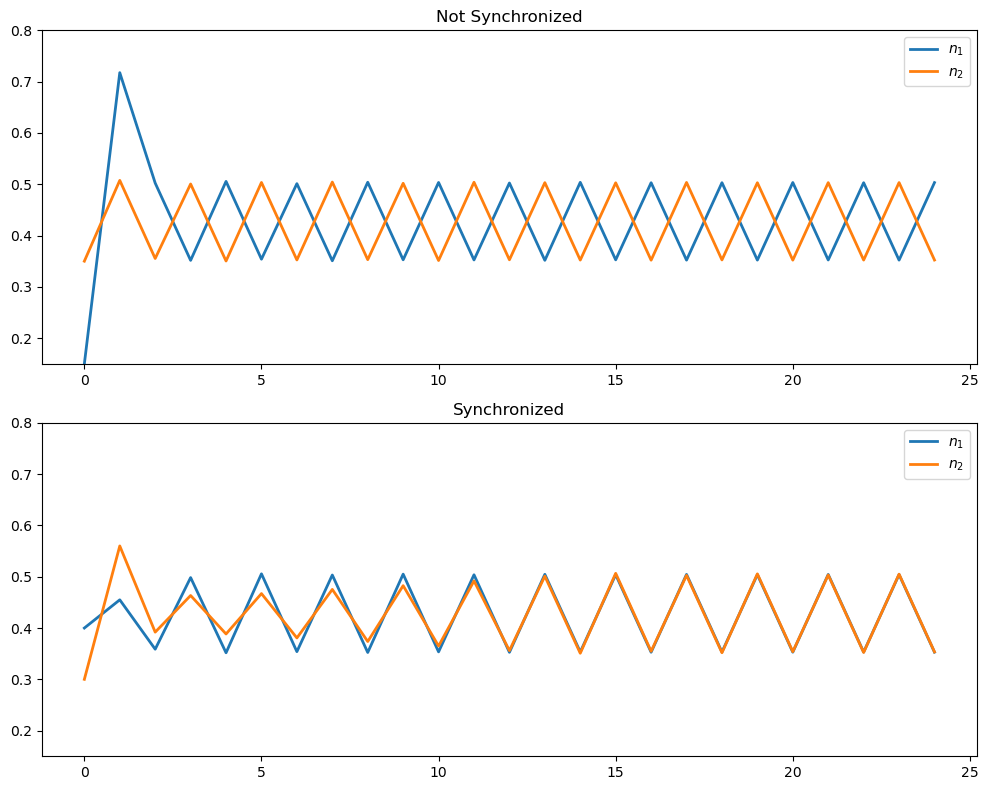

We write a short function below that exploits the preceding code and plots two time series.

Each time series gives the dynamics for the two countries.

The time series share parameters but differ in their initial condition.

Here’s the function

def plot_timeseries(n1_0, n2_0, s1=0.5, θ=2.5,

δ=0.7, ρ=0.2, ax=None, title=''):

"""

Plot a single time series with initial conditions

"""

if ax is None:

fig, ax = plt.subplots()

# Create the MSG Model and simulate with initial conditions

model = MSGSync(s1, θ, δ, ρ)

n1, n2 = model.simulate_n(n1_0, n2_0, 25)

ax.plot(np.arange(25), n1, label="$n_1$", lw=2)

ax.plot(np.arange(25), n2, label="$n_2$", lw=2)

ax.legend()

ax.set(title=title, ylim=(0.15, 0.8))

return ax

# Create figure

fig, ax = plt.subplots(2, 1, figsize=(10, 8))

plot_timeseries(0.15, 0.35, ax=ax[0], title='Not Synchronized')

plot_timeseries(0.4, 0.3, ax=ax[1], title='Synchronized')

fig.tight_layout()

plt.show()

In the first case, innovation in the two countries does not synchronize.

In the second case, different initial conditions are chosen, and the cycles become synchronized.

14.4.2. Basin of attraction#

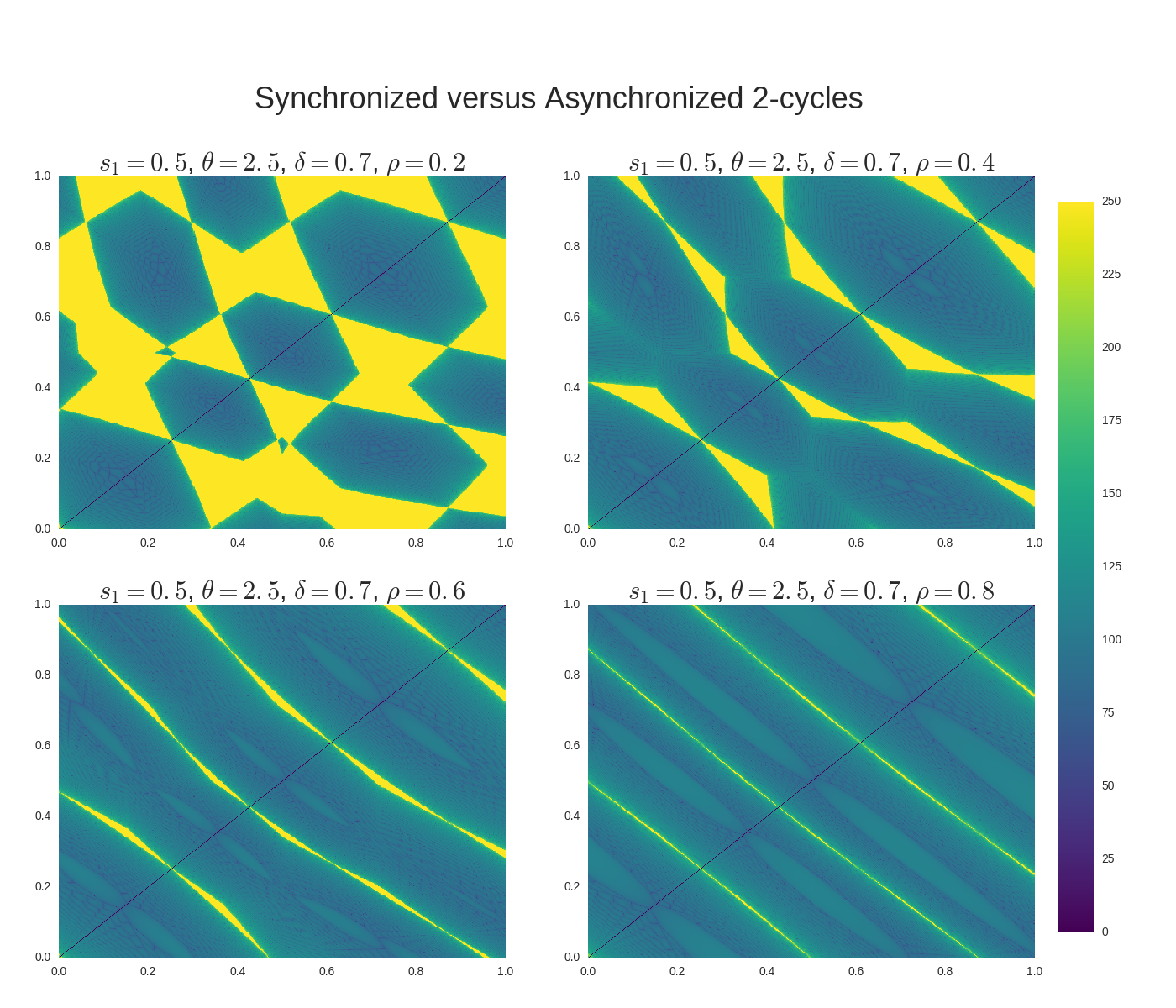

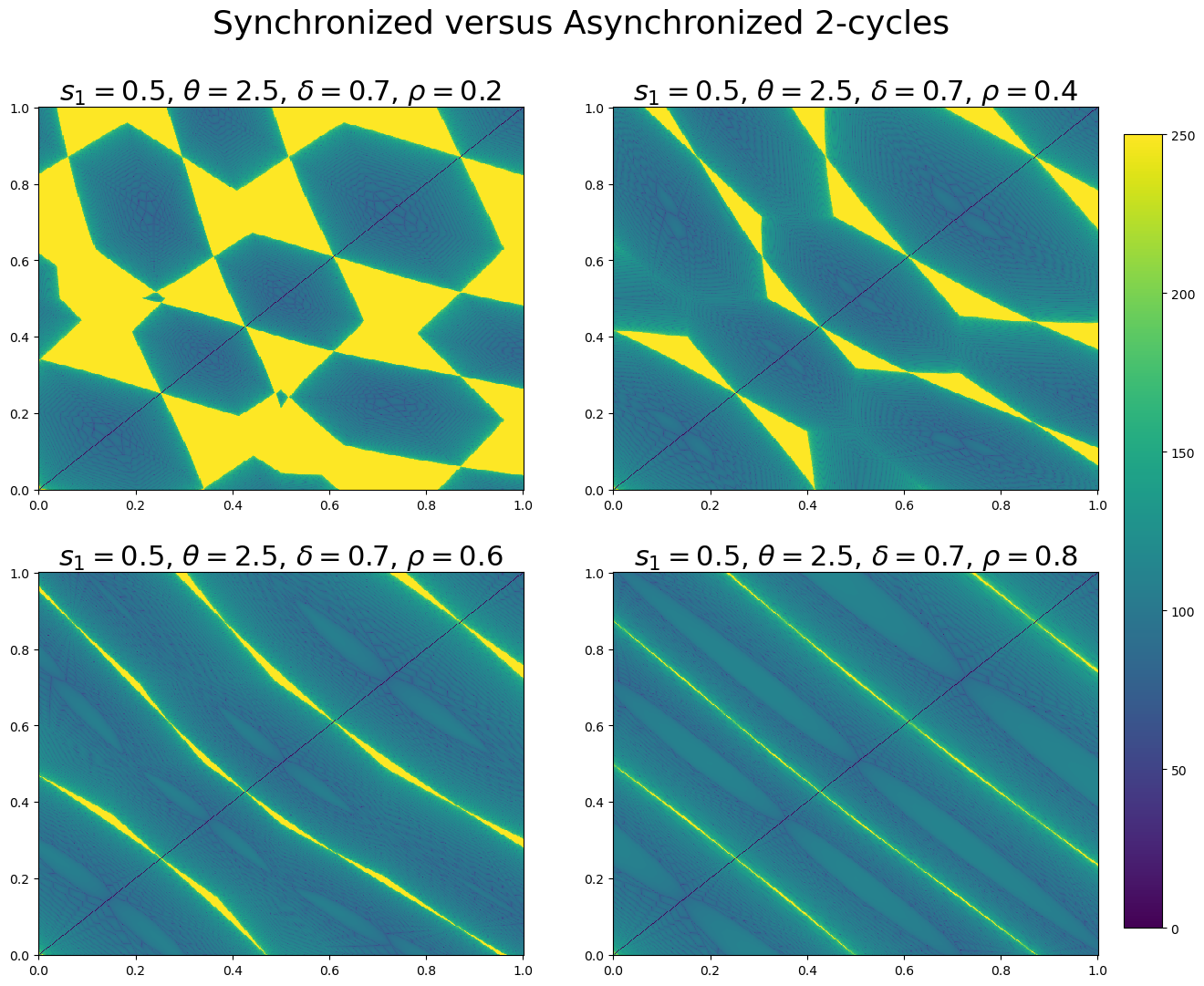

Next, let’s study the initial conditions that lead to synchronized cycles more systematically.

We generate time series from a large collection of different initial conditions and mark those conditions with different colors according to whether synchronization occurs or not.

The next display shows exactly this for four different parameterizations (one for each subfigure).

Dark colors indicate synchronization, while light colors indicate failure to synchronize.

As you can see, larger values of \(\rho\) translate to more synchronization.

You are asked to replicate this figure in the exercises.

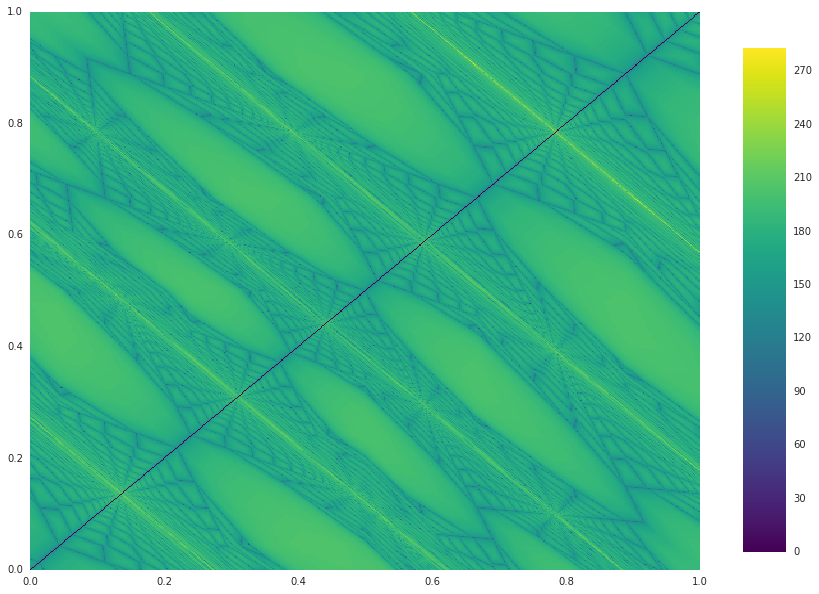

In the solution to the exercises, you’ll also find a figure with sliders, allowing you to experiment with different parameters.

Here’s one snapshot from the interactive figure

14.5. Exercises#

Exercise 14.1

Replicate the figure shown above by coloring initial conditions according to whether or not synchronization occurs from those conditions.

Solution

def plot_attraction_basis(s1=0.5, θ=2.5, δ=0.7, ρ=0.2, npts=250, ax=None):

if ax is None:

fig, ax = plt.subplots()

# Create attraction basis

unitrange = np.linspace(0, 1, npts)

model = MSGSync(s1, θ, δ, ρ)

ab = model.create_attraction_basis(npts=npts)

cf = ax.pcolormesh(unitrange, unitrange, ab, cmap="viridis")

return ab, cf

fig = plt.figure(figsize=(14, 12))

# Left - Bottom - Width - Height

ax0 = fig.add_axes((0.05, 0.475, 0.38, 0.35), label="axes0")

ax1 = fig.add_axes((0.5, 0.475, 0.38, 0.35), label="axes1")

ax2 = fig.add_axes((0.05, 0.05, 0.38, 0.35), label="axes2")

ax3 = fig.add_axes((0.5, 0.05, 0.38, 0.35), label="axes3")

params = [[0.5, 2.5, 0.7, 0.2],

[0.5, 2.5, 0.7, 0.4],

[0.5, 2.5, 0.7, 0.6],

[0.5, 2.5, 0.7, 0.8]]

ab0, cf0 = plot_attraction_basis(*params[0], npts=500, ax=ax0)

ab1, cf1 = plot_attraction_basis(*params[1], npts=500, ax=ax1)

ab2, cf2 = plot_attraction_basis(*params[2], npts=500, ax=ax2)

ab3, cf3 = plot_attraction_basis(*params[3], npts=500, ax=ax3)

cbar_ax = fig.add_axes([0.9, 0.075, 0.03, 0.725])

plt.colorbar(cf0, cax=cbar_ax)

ax0.set_title(r"$s_1=0.5$, $\theta=2.5$, $\delta=0.7$, $\rho=0.2$",

fontsize=22)

ax1.set_title(r"$s_1=0.5$, $\theta=2.5$, $\delta=0.7$, $\rho=0.4$",

fontsize=22)

ax2.set_title(r"$s_1=0.5$, $\theta=2.5$, $\delta=0.7$, $\rho=0.6$",

fontsize=22)

ax3.set_title(r"$s_1=0.5$, $\theta=2.5$, $\delta=0.7$, $\rho=0.8$",

fontsize=22)

fig.suptitle("Synchronized versus Asynchronized 2-cycles",

x=0.475, y=0.915, size=26)

plt.show()

Additionally, instead of just seeing 4 plots at once, we might want to manually be able to change \(\rho\) and see how it affects the plot in real-time. Below we use an interactive plot to do this.

Note, interactive plotting requires the ipywidgets module to be installed and enabled.

Note

This interactive plot is disabled on this static webpage. In order to use this, we recommend to run this notebook locally.

def interact_attraction_basis(ρ=0.2, maxiter=250, npts=250):

# Create the figure and axis that we will plot on

fig, ax = plt.subplots(figsize=(12, 10))

# Create model and attraction basis

s1, θ, δ = 0.5, 2.5, 0.75

model = MSGSync(s1, θ, δ, ρ)

ab = model.create_attraction_basis(maxiter=maxiter, npts=npts)

# Color map with colormesh

unitrange = np.linspace(0, 1, npts)

cf = ax.pcolormesh(unitrange, unitrange, ab, cmap="viridis")

cbar_ax = fig.add_axes([0.95, 0.15, 0.05, 0.7])

plt.colorbar(cf, cax=cbar_ax)

plt.show()

return None

fig = interact(interact_attraction_basis,

ρ=(0.0, 1.0, 0.05),

maxiter=(50, 5000, 50),

npts=(25, 750, 25))